In a recently released paper called The Use of Social Capital in Borrower Decision-Making by a doctoral student at Harvard, Cassi Pittman, with the support of the NeighborWorks America’s Emerging Leaders in Community and Economic Development Fellowship and the Joint Center for Housing Studies of Harvard University. This research focuses exclusively on black borrowers’ search for and obtaining of mortgage

financing.

Because of wide variations on mortgage borrowing patterns based on race, this study looks at mortgage patterns from the demand perspective. In other words: how do individuals decide to go with a particular lender or mortgage product?

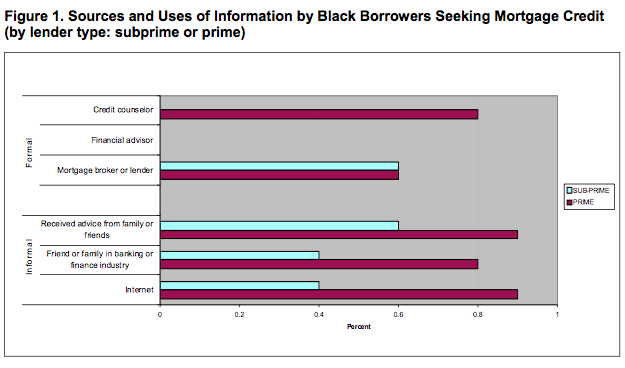

>The preliminary findings indicate that borrowers’ preferences and subsequent demands for

mortgage products were shaped by the informal and formal advice they received. Those

borrowers who consulted the most diverse sources of information had loans with lower

interest rates. Those borrowers who received advice only from family and friends did not fare

as well as those who received help from credit counselors. Thus, arguably, their loan

outcomes varied not just based on if they consulted others, but especially whom they

consulted. When given the right advice, potential homebuyers make better decisions in

choosing both a lender and a loan.

The report sample size is arguably small and because of the quickly changing environment, feels a little dated (ie 65% of origination is via mortgage brokers – it must be half that market share or less right now), but its well written, presented and even better…it’s interesting, covering such on an abstract subject.

Just sitting through a closing, illustrates the futility of federally mandated mortgage disclosures. Not only are the volumes of documents cumbersome and lack clarity, but it serves to confuse borrowers even more. When borrowers do not understand the terms of

their mortgage and the fees associated with the transaction, they are more likely to be victims

of lending abuses and to be charged “fees that far exceeded what would be expected justified

based on economic grounds”. The mortgage rates charged were as high as 16% in a low mortgage rate environment. 2-28 (2 years fixed, 28 years adjustable) were among the most popular.

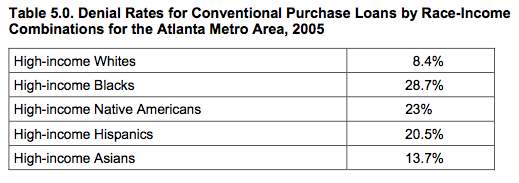

Of course, conventional mortgage denial rates played a role in fueling demand for subprime products.

>Obtaining a mortgage in today’s mortgage market is a complicated process. When reaching a

decision on a home loan, borrowers might feel compelled to use their social networks for

information and guidance. Loan products have become increasingly complex. Federally

mandated mortgage disclosure forms, instituted to display the cost of the mortgage transac-

tion and to prevent “the uninformed use of credit,” have been found to poorly convey the true

cost of borrowing.

With all the talk about social networks, the social network that influences a mortgage decision is particularly powerful and the financial stakes are high.