I was on hiatus for no particular reason last week, other than having a little too much going on. Some big announcements coming soon, but unfortunately, my first foray into lobster fishing last week was a bust (translation: no lobsters). It was painful not to enter the Matrix last week, but I think there is something that can be said for taking a break every so often.

One of the significant effects of the housing boom was the rapid response in employment of real estate agents as well as the surge in membership in NAR in recent years. The barrier to entry and exit is low and makes the profession vulnerable to competition, namely to gains in innovation, as agents move from information gatekeeper to information interpreter. It is incumbent upon real estate brokerage firms to adapt to the growing openness of information available to consumers. Some firms will get it and some will not.

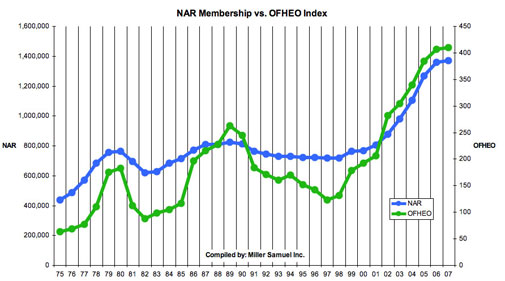

I created the above chart to show correlation between housing prices using OFHEO and NAR membership just for fun. While housing prices are more volatile, the trend is similar over the past 20+ years.

I suspect that with the sharp drop in the number of housing sales across the country, a sharp drop in NAR membership will follow, in fact it already has begun. Actually, I am surprised the membership fall off has not been more significant to date, but I suppose, like housing prices, membership contraction is “sticky on the downside.”

The New York Times article As Housing Market Cools, Far Fewer Become Agents covered the topic quite well. The numbers of licensed agents are falling with the number of transactions. In fact I noticed that the article seemed to focus on markets that saw heavy speculative activity and I’ll bet the run-up in the number of agents was especially pronounced there.

In many ways, the decline in the number of agents is probably good for good agents as well as the consumer. The market has undergone significant changes in the past 2 years, including rising inventory, falling transaction counts and falling prices in many markets.

Agents that are able to adapt to the new market may actually thrive and be able to service their customers in a more professional way. The ability to grab the low hanging fruit of the last five years has resulted in a lot more competition among agents and I suspect the image of most real estate agents making money hand over fist in the past five years was really isolated to the top 5-10%.

I don’t wish unemployment on anyone, but the market ultimately decides.

4 Comments

Comments are closed.

[…] NAR membership rises & falls with housing prices (Matrix) […]

NAR and local dues are due and paid in December every year. When this annual bill comes due, we will see the damage to the numbers in Jan ’08.

[…] Jonathan Miller, Real Estate Employment: Lower Bar = Faster Response To Market Conditions […]

Great statistics for something I have experienced since 1991. There is no doubt in my mind that the herd will be weeded out!