_[This quarterly market report is provided by Dr. Kevin Gillen, an economist at the Real Estate Department of the Wharton School and Fellow of the University of Pennsylvania. He analyzes the Philadelphia real estate market using the city’s real estate database through [Hallwatch](http://www.hallwatch.org), a watchdog group. The results are published in a research paper called Philadelphia House Price Indices each quarter as a public service to the Philadelphia real estate community. [Here’s his methodology [pdf]](http://www.goppelt.net/phpi/phpi_faq.pdf)_

_Its informative and I am glad I am able to present his efforts on Matrix]_ -Jonathan Miller

[Download the full report [pdf]](http://www.goppelt.net/phpi/phpi1q06.pdf)

_The Philadelphia real estate market continued to cool in the first quarter_

* The number of houses on the market jumped by 39%, but the number of actual sales fell to its lowest level in 2 years.

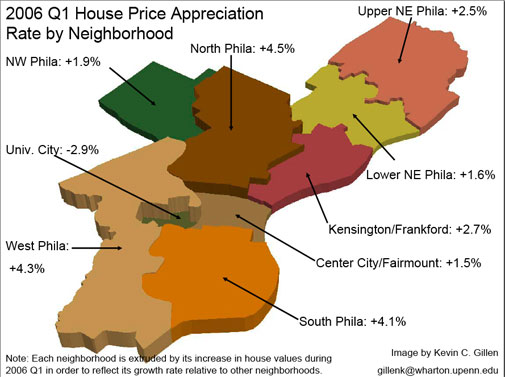

* Across neighborhoods, the trend was the same: homes appreciated less than 5%.

* Compared to other cities, Philadelphia is “on the fence”: it is not considered as safe as cities in the country’s interior, but it is nowhere near at-risk as some of the other coastal so-called “bubble markets”.

* The percentage of Philly home sales that we’re financed with relatively risky mortgages (e.g. interest-only and negative amortization) varies from 7-19%.

* The percentage of Philly homes purchased as investments in 2005 was 10%, compared to 15-20% in these other markets.

[More discussion concerning the report [Hallwatch.org].](http://www.hallwatch.org/news/1147205290718) [Hallwatch](http://www.hallwatch.org) is a private and independently maintained watchdog website that does a lot of in-depth, independent and investigative pieces on city politics, as well as real estate.