One of the common refrains of borrowers about to be swallowed by an adjustable mortgage is

>I have heard of mortgage resets but I had no idea this would happen. I need some help.

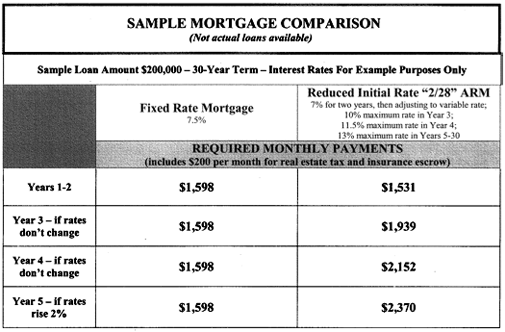

…but if I had a picture of what would happen, perhaps I would not gotten into this predicament… I am skeptical that if this were in place before the mortgage boom it would have made much of a difference but still, I think its a good idea to help clarify things.

You have to remember, the urge to purchase was overriding logic. For example, 50 year mortgages were introduced to keep the payments low.

In order to reduce this “deer in the headlights” problem for borrowers, the FDIC is specifically targeting subprime borrowers with this announcement:

Hey, its not going to prevent fraud and financial tragedy, its a start in the right direction. Of course, it sets back the movement towards reducing the regulatory paperwork.

Here is the announcment with the illustrations attached.

One Comment

Comments are closed.

I think that a lot of lenders don’t adequately explain how repayment schemes or mortgages work. Then, when someone falls into a ditch, negligence is never and excuse and people get stung. More should be done to ensure that people fully understand what they are getting themselves in for.