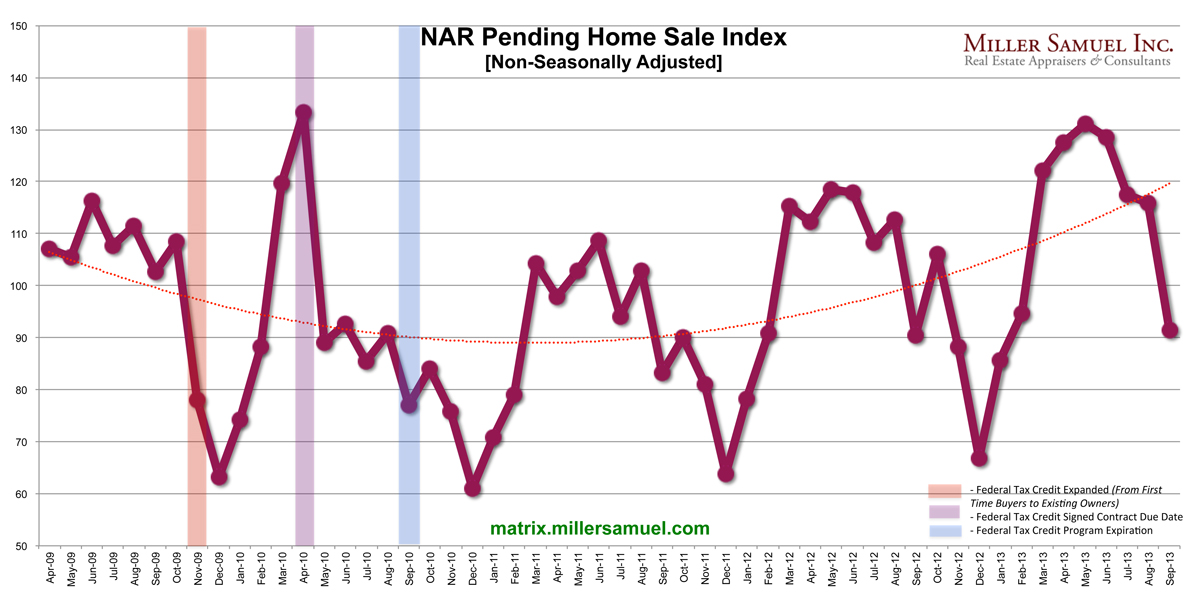

According the National Association of Realtors, their Pending Home Sales Index fell 5.6% from August to September 2013 (seasonally adjusted), the largest monthly drop since May 2010 after the artificial prop of the 2009-2010 federal homebuyers tax credit expiration caused contracts to drop by nearly 1/3 from bloated levels.

Removing seasonality from the results makes the year-over-year adjustment show nominally 1.1% higher contract volume from September 2013 than in 2012 rather than a 1.2% decline. Still, the results were weak.

Why did pending sales post weaker results?

– Don’t blame the partial government shutdown – that came later.

– After the May 2013 Fed surprise announcement, fence sitters surged to the market to lock in before mortgage rates rose further, bloating contract volume over the summer (and why month-over-month seasonal adjustments to this data are so very misleading).

– The surge in summer sales “poached” from future organic volume that we would have seen in September so we were already expecting a slow down in volume. Didn’t we learn in 2010 what happens when unusual circumstances press volume sharply higher only to see volume fall sharply when that circumstance disappears?

Weaker conditions prevail, but its really not as bad a report result as being discussed – namely because the seasonal adjustments paint a weaker picture than what actually happened, and we expected a decline in activity because the prior several months were artificially pushed higher with so many more buyers rushing to the market to beat rising rates (or the perception of rising rates).