In David Berson’s weekly column, he discusses the [recent downward trend in homeownership [FannieMae]](http://www.fanniemae.com/media/berson/weekly/index.jhtml;jsessionid=2ACMHGIHNEGVVJ2FECHSFGA?p=Media&s=Economics,+Housing+%26+Mortgage+Market+Analysis&t=Berson’s+Weekly+Commentary)

>For a decade, the national homeownership rate rose every year — climbing from 64.0 percent in 1994 to an all-time high of 69.0 percent in 2004. Last year, however, the homeownership rate slipped just a tad to 68.9 percent — but with a rebound in the fourth quarter to 69.0 percent, it was hoped that the long-term upward trend would continue. We have been concerned that, at least in the near-term, declining affordability would make it difficult for homeownership rates to advance. The latest data appear to bear this out, as the homeownership rate dropped to 68.5 percent in the first quarter of 2006 — the lowest level since the middle of 2003.

Fannie Mae found that there is a direct correlation, with a slight lag time, between affordability and homeownership. Affordability peaked in mid-2003 when the 30-year rate bottomed out. Affordability has dropped since 2003.

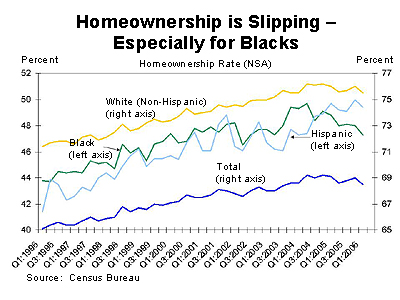

_[I’d have to say that the chart presented here is a bit misleading but appears meant to be efficient due to the different scales on each left and right Y-axis and omission of some smaller ethnic groups -ed]_

This trend was not evenly distributed along racial lines since 2003 as it had been over the prior 10 years. White (non-hispanic) homeownership was consistent with the overall trend and peaked at about 76% with a slight decline since 2003. African-Americans and Hispanics trended together over the past decade but seemed to go out of sync in 2003 with more voltility. Hispanics home ownership appears to have surged from 46% in the past 2 years settling just below 50%, while homeownership for African-Americans fell from about 49% to 47.3% over the same period.

In 1994, overall homeownership was 64% and their goal was to reach 70%. The effort was focused on reaching _minority and underserved_ Americans with a goal of [specifically reaching 55% of this market within 10 years](http://recenter.tamu.edu/tgrande/vol12-4/1746.html). Both efforts fell short of goals but their efforts have been considered successful. The efforts focused on _major barriers to homeownership – down payment, low income and credit history_

Perhaps one could argue that one of the reasons Fannie Mae missed their targets was due to the [accounting scandals [SOD]](http://www.signonsandiego.com/uniontrib/20060219/news_1h19fannie.html) that plagued them in 2003 and 2004.

I’d have to guess that their efforts over the past five years did influence minority homeownership gains but overall increases were largely due to low mortgage rates. I would expect the decline of homeownership to continue as mortgage rates continue to rise. Homeownership is a trailing indicator, not a leading indicator. As affordability goes, so goes housing.

_[Note: Berson’s link lasts one week. After 5/16/06, go here and search for his 5/10/06 post.](http://www.fanniemae.com/media/berson/weekly/archive/index.jhtml;jsessionid=GQATCTK1I5SX1J2FQSHSFGI?p=Media)_