The other day I came across a brand new form for use on Wells Fargo mortgage appraisals

>On February 13, 2010, the Wells Fargo RVS Desktop Appraisal (RVS Desktop) will be released into production. This is a streamlined desktop appraisal report to be completed by Licensed or Certified appraisers only. The Desktop Appraisal Form will be accessed through AppraisalPort using FNC’s Data Express system.

FNC has long been an innovator in the collateral management business and I recently interviewed its controversial co-founder. Their automation/statistical orientation doesn’t leave much room for human interpretation of property value. They provide a web portal to many national and regional lenders for a variety of mortgage related services including appraisals.

Some of the highlights of their new appraisal product provided for Wells Fargo is designed for SFR, PUD, and Condominium assignments.

* The fee is $55 to be paid for each completed assignment that meets the reporting requirements.

* The FNC/AppraisalPort Fee is $4 for each returned assignment with a value.

* The Service Level Agreement (SLA) for completing the assignment is two (2) days.

So a professional appraiser – a local market expert – has to crank out a thorough analysis on a property for a fee of $55, within 2 days and pay $4 to upload the report through AppraisalPort to Wells Fargo.

Technology sure is cool. Of course common sense clearly says that the least competent appraisers out there will sit at their desks and crank these reports out. No lessons have been learned from the credit crunch.

Needless to say, my firm won’t be performing these types of assignments and it is very clear that the “greater fool theory” also applies to appraisers.

16 Comments

Comments are closed.

Why don’t they just make it a flat $49.95, the same amount as an Earl Scheib auto paint job (c. 1970). Seriously, when I stopped laughing I was not surprised at all. I alsmost lost a house deal last week due to Wells because the buyer was so fed up with them and their lack of communication he he walked away. After he went to another bank (who issued a commitment in four days), the Wells commitment showed up with several pages of conditions. The new bank had only about seven items. The buyer has top notch credit btw.

Conservative and careful – admirable. But that is some other bank.

Around 25 years ago I used to make double or triple the proposed fee to appraise coop apartments in Westchester. So much for inflation….

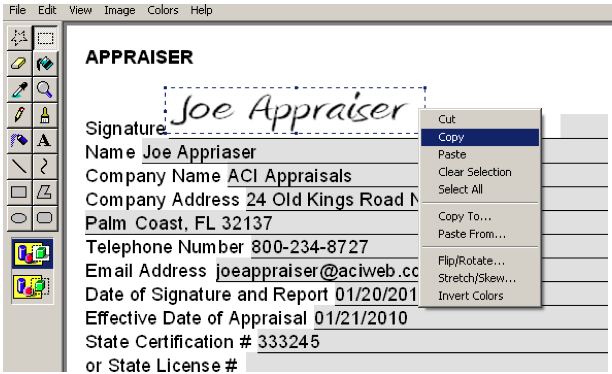

Nice take, Jonathan. It’s interesting to note the incompetence exhibited by the screen shot you selected from their instruction manual for this “exciting product”.

Appraiser is misspelled. The Effective Date of the valuation is after the date of signature and report.

Of course, there’s also the small detail of the contingent fee arrangement, but why should Wachovia/Wells concern themselves with an appraiser’s obligation to comply with USPAP when there’s money to be made.

Keep up the good work, and let us know if you get a nasty-gram too!

Thanks, but is anyone surprised? The lenders learned nothing so much that if they are in enough trouble the taxpayers will bail them out. Why should anything change?

Of course it leaves us with the question we have struggled with for quite qwhile. What are we doing here? I hear the courts may be becoming as concerned about the quality of appraising as we are, but the message is not falling on willing ears.

I’m not at all sure this profession is suviving the myriad pressure from lenders, but when viewed from the perspective of the lenders, why should it?

I got involved post-USPAP and believed appraising was evolving not with survival of the fittest as a premise, but along the lines that quality had priority. HO, HO.

Has a bail out for appraisers been mentioned anywhere?

Frank,

Tha a p p r i a s e r is from FL too. Just saying.

Great commentary! I’ll let you know if I am contacted. In my haste to post this before I left for vacation (I’m still on vacation) I typed “full” instead of “fool” in the title. I just fixed. Of course if I was making $55 dollars to crank this post out I would have been a lot more accurate originally.

Nice post. I have seen so many appraisal issues over the last 12-18 months, I don’t know where to start! My most recent issue involved BofA and an apt on the UWS. Landsafe was convinced that a 2 bed only had 1 bed, and they valued it $200K below it purchase price 24 months ago. Love this new model….

$55 is not going to produce credible results. What do they pay for BPOs? Is this a comparable fee? Just curious.

My biggest concern is that FNC is still ‘data-mining’ and that the report I submit is not as secure as it is said to be because it goes through their system. My second concern is that for Southern California the market has been in the hands of the banks for the past two years. The inconsistencies I have observed between the MLS Reports and what the actual condition of the properties is at the time of the appraisal is such that I have not, and will not, perform any valuation that does not involve an inspection of the Subject and Comparable Sales. If WFB wants to keep the loans these ‘appraisals’ are used for, that is their loss. If they try to sell the loan with one of these rags, I as the investor would decline the purchase and would remind them of the rules. I believe our end clients, the investors, should become involved in this as they are the ones who will suffer the greatest loss.

I still don’t get this.

The complaint is that they are trying to streamline something without letting the appraiser make his/her own interpretation of the data, correct?

Is the other issue that they are paying appriasers to use their service, which seems unethical?

How does the company make money off this? Do they share the appriaser’s info with Wells Fargo?

I’m trying to figure out what the problems are, but I’m not a very smart person.

Join us over in the “USPAP, Uniform Standards of Professional Appraisal Practice” Group on LinkedIn where we have spent a fair amount of time picking this form apart. On its best day the report form is a sham. Our State Regulator has indicated he expects this form will yield lots of cases for him to prosecute. I hope Appraisers are informed and understand they are throwing their license in the toilet for using this form. Forget the fee, the problem is the form makes multiple violations of USPAP, what good is any fee, if you have no license anymore?

This sounds like more of the same crap? Has anybody seen their form? Insanity is rampant. Amongst the nonsense on their site is the link and the comment below it that I found, sounds like another report to line the garbage can with.

http://www.appraisalworld.com/CompCruncher/

“We are working with lenders and servicers that have orders pending national coverage by appraisers skilled in producing a Collateral Valuation Report. We need appraisers to fulfill these orders. Here’s the ROI: You can make $75 per report, each report takes 30-40 minutes. Do two reports per day and you are making roughly $120/hr for that effort.”

John – FNC (a collateral mgt firm) developed an online appraisal form for one of its clients, one of the largest lenders in the US – who will be using it and asking their appraisers to use. The fee is a small fraction of the market rate (10-20% in many markets). When the appraisal is completed, the appraiser uses the FNC portal to upload the report in to the bank and pays $4. FNC acts as a toll collector – this is how a large number of appraisals across the US are processed. We use a portal to get the order and send the finished report back or communicate with the client and are charged a fee (which keeps rising).

Good appraisers who refuse and can’t afford to work at these fees will be forced out by those who can, but since the quality review of the appraisals being done reflects the same sort of thinking, you will see a continued erosion in appraisal quality.

The implications for quality decline are a disaster and amazing given the credit crunch we are going through. If lenders did not have a federal backstop to bail them out, this behavior wouldn’t be happening.

Its called moral hazard.

Frank makes an excellent point that I completely overlooked in my post in his always insightful Appraiser Active Blog:

http://appraiseractive.blogspot.com/2010/02/what-about-that-wells-fargo-rvs-desktop.html

The word “Appraiser” under the scripted text for “Joe Appraiser” is spelled wrong! Good grief – it would be reasonable to assume that appraisers were not a meaningful part of the development process.

These are great comments. I will give you a bit of the broker/former appraiser perspective. I take a great deal of time with my buyers and sellers to educate and prepare them about the current state of HVCC and its impact on valuation and the risks to their deal. I tend to use USPAP and the Geographic Competency Rule as a sword and make it plain to them and the mortgage broker that I do not give a damn about HVCC, and that the first question when the appraiser calls is “where are you from?” If it is not local (and Staten Island is NOT local for Westchester), then they are not setting foot on the property. If they bitch, all I say is U S P A P. Most of the time they have never heard of it, but that is another story lol.

I would not do a BPO for $50, so I cannot imagine how an appraiser would ever do an appraisal for a net “profit’ of $51. I always seem to get the BPO emails 10 minutes after the sun has set, demanding a drive by BPO due at 9 am the next morning for $50. They are usually in less then nice areas too. So I guess I should go out and take those 3 am infrared pictures for $50. I don’t think so.

It has become so bad I actually miss the good old days of FIRRERA.

Jonathan,

After Wachovia emailed me with the nasty-gram demanding I remove my blog post about the desktop appraisal “product”, I altered the blog post by utilizing another, non-Wachovia announcement. Afterwards, I responded to their email with some observations and concerns of my own.

Specifically, I pointed out the offer represented a contingent fee arrangement. Their no-pay/pay offer for NO HIT/HIT is clearly a fee that depends on assignment results. Along with many other appraiser observers, this is contrary to the Management Section of the Ethics Rule of USPAP. There is no way an appraiser accepting one of these desktop assignments could comply with the Certification (#5) attached to the form report. Although it affects only those in the Sunshine State, accepting the assignment may be a violation of Florida Law; 475.624 (17).

In discussions of the “product” others have opined that there may a problem in compliance with the Scope of Work Rule due to constraints on the selection of Comparable Sales and data sources. I’ll let them weigh in on that.

FTR, I have no problem with a desktop appraisal. IMNSHO, it’s possible to comply with USPAP and Florida Law, and produce a credible opinion of value without inspecting the subject property. However, the fee must not be contingent on assignment results, the appraiser must determine and perform the Scope of Work necessary to develop credible assignment results. Communication with the client is necessary to ascertain the intended use, and the client must realize the scope of work determined by the appraiser might change, depending on what is discovered once the assignment has been accepted.

I’ll let others argue about the fee. The offer is not sufficient to attract my interest, but others’ mileage may vary.

There must be a misunderstanding on my part here, as it reads as though the appraiser is only getting a $55 fee for generating an official appraisal. I’m not one, but know that they spend a good amount of time generating the data (driving, visiting, photos)and then refining that data.

Please don’t tell me that the “gross revenue” is $55 per appraisal…