This quarterly market report is provided by Dr. Kevin Gillen, an economist at the Real Estate Department of the Wharton School and Fellow of the University of Pennsylvania. He analyzes the Philadelphia real estate market using the city’s real estate database through Hallwatch, a watchdog group. The results are published in a research paper called Philadelphia House Price Indices each quarter as a public service to the Philadelphia real estate community. Here’s his methodology [pdf].

Kevin does a great job parsing out the market and its a pleasure to share his results on Matrix —Jonathan Miller

Download the full report [pdf].

Read the Hallwatch article on the market: Philly real estate: low level of sales, price changes mixed

>But while the Philadelphia’ market has declined less than many other U.S. cities, the news here is still sobering:

* Inventories (homes listed for sale) still stand at all- time high levels. As of September, there were nearly 11,000 houses listed for sale in Philadelphia, nearly double their pre- bubble average.

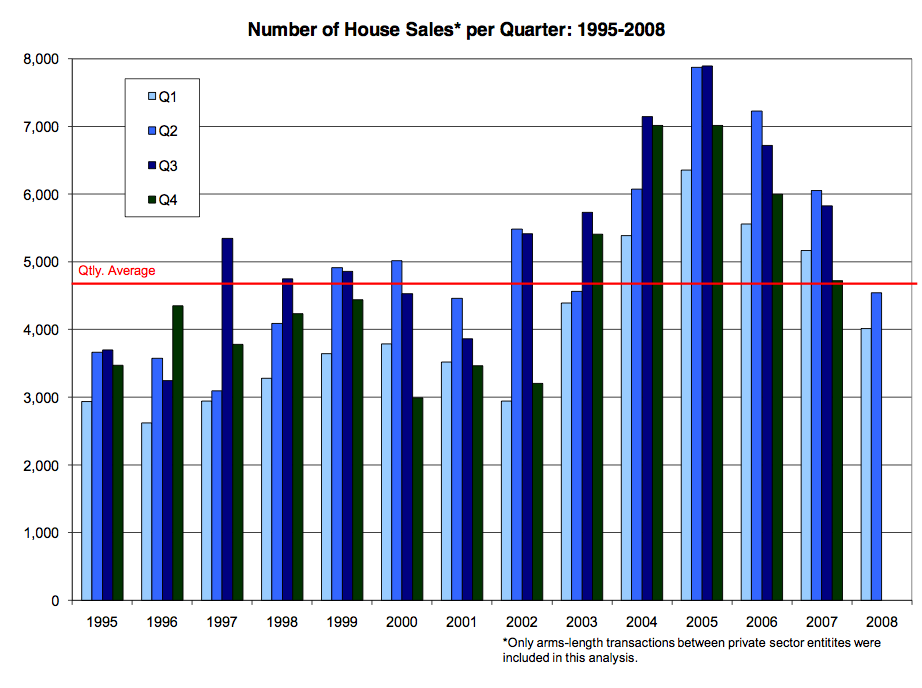

* The number of homes that actually sold under arms-length conditions in Q3 stood at just over 4,500; well below the nearly 8,000 that was the average during the boom years.

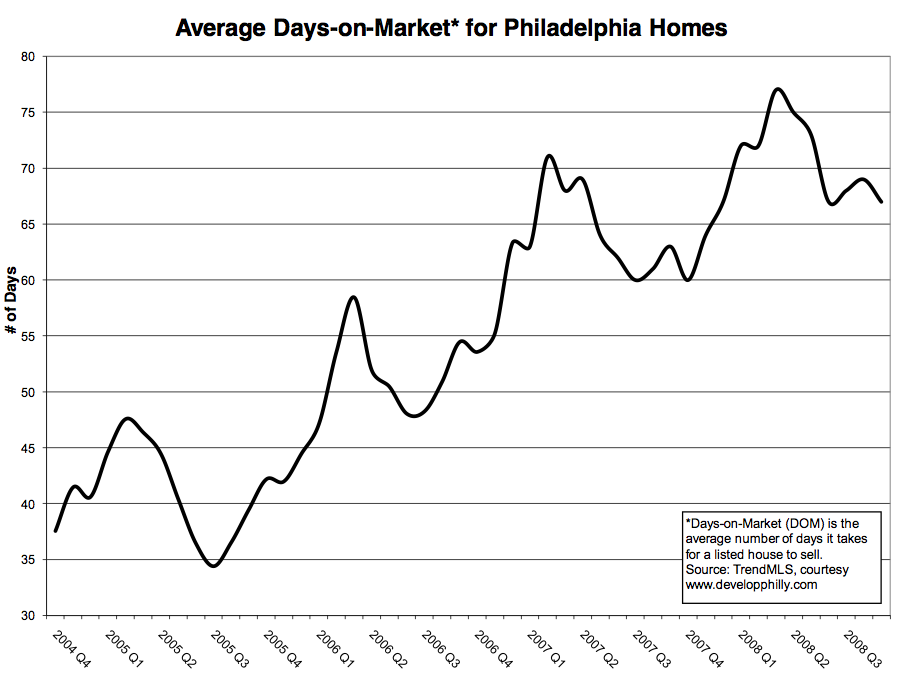

* The continued high number of homes for sale combined with a continuously shrinking pool of buyers means homes continue to linger on the market. The average time it took to sell a home in Philadelphia in Q3 was 67 days, which is well above the 30-40 days it takes in a balanced market.

* And, while Philadelphia’s rate of foreclosure is well below the average for most large U.S. cities, it is nonetheless up nearly 50% from one year ago.

More discussion concerning the report [Hallwatch.org]. Hallwatch is a private and independently maintained watchdog website that does a lot of in-depth, independent and investigative pieces on city politics, as well as real estate.

2 Comments

Comments are closed.

Philly has been pretty reasonable for a while now, as far as house prices go. The bubble didn’t hit there as much as it did in other areas of the country. Relatively the prices stayed mostly steady.

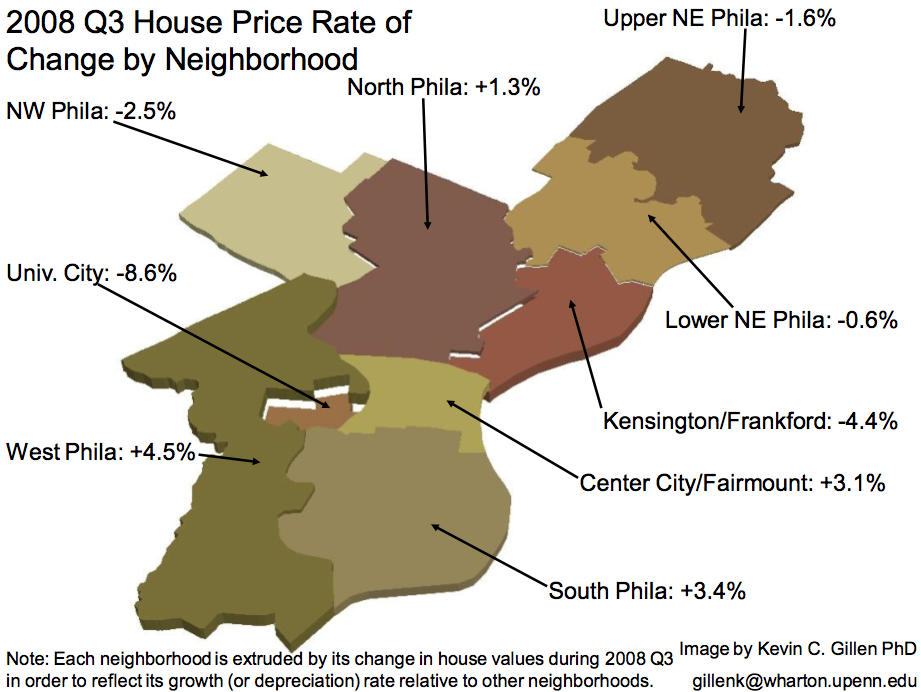

Reasonable? When in 1998? Philadelphia’s overpricedness is long overdue for a correction. Some areas will be fine, some will correct, but others will see a decline. If I were to guess, I’d say the lower NE and NW Philly are due for very sharp declines once the credit crunch sets in. Those areas tripled in some cases almost unanswered. Let’s be realistic here.