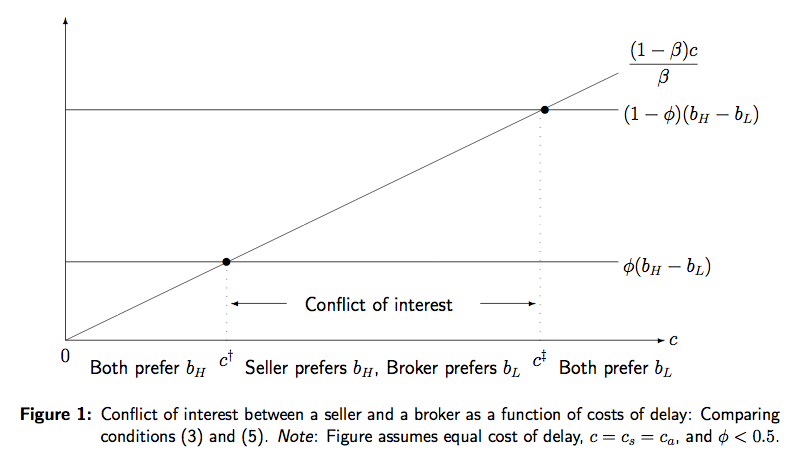

An interesting study from an economist at the Boston Fed that discusses the relationship between a seller and the real estate broker hired to sell in the property. What’s interesting to me is that the conflict of interest is measured by the costs associated with the delay in selling the property. That’s a clever way to quantify.

Real Estate Brokers and Commission: Theory and Calibrations

by Oz Shy (What a cool name!)

The conclusion of the 6% model:

>The findings suggest that while the pressure brokers exert on sellers to reduce prices generates faster sales and hence improves social welfare, the usual commission rate of 6 percent exceeds the seller’s valueâ€maximizing rate if the sale is handled by a single agent. On the other hand, if several agents (such as the buyer’s and seller’s brokers and the agencies that employ these realtors) split the commission, then a 6 percent commission rate may be required to motivate the broker to sell at a high price.

On the plus side…

>Two-sided market and network effects: Real estate brokers are connected via computerized networks that expose them to a large variety of houses for sale. Buyers are aware of that and will therefore hire an agent who is also connected to the same network. Sellers know that buyers tend to hire agents who are also on this network, which induces more sellers to enlist. This “snowball” effect can potentially magnify until all sellers and buyers connect via agents to the same network of realtors.

When I went to sell my last house, I toyed with doing it myself, but rationalized that I would receive less exposure and the my net would end up being more than if I sold it myself, before I figured in the hassle/time factor and my fear of screwing up my biggest investment.

On the down side…

>Conflicting interests: Agents may provide sellers with certain information on the housing mar- ket in order to lead them to settle on a lower price compared with the price that would maximize sellers’ expected gain. Lower prices would increase the probability of finding a buyer and would also shorten brokers’ expected waiting time until the transaction takes place, allowing them to collect their commission sooner.

There seems to be a lot of weight given to the idea that real estate brokers want the price as low as possible to lift transaction volume.

While I agree there is a structural conflict, I think the premise as presented is overly simplistic. Yes, if the price is lowballed, the property will move quickly.

In my 23 years of interacting with brokers in my appraisal work, in a number of housing markets, I have found that the sellers generally hold sway over the brokers. The idea that the seller simply accepts the broker’s price recommendation is not real world. Of course there are good agents and bad agents just like any profession.

In fact, the sellers are armed with a lot more information than ever before – a lot of it is incorrect or misleading and in my experience, causing sellers to be less reliant on the agent’s initial advice.

There are all sorts of models out there trying to find an alternative to the traditional brokerage model or fit in as an alternative to the traditional model. Some ideas will be successful and some won’t, but to date, there hasn’t been an “ah-ha” model to arrive.

So until the industry will remain conflicted.

5 Comments

Comments are closed.

I wonder why the data source of the “standard” commission of 6% is not cited. This is such a huge part of the analysis. Where did Shy get 6%? I agree that anecdotally that is what is quoted but let’s see the average across all transactions in the nation for a year. I thought that the latest NAR surveys (plus a survey by Keller Williams) shows that in 2008 it was actually about 5.2%. To me the “5% reality” changes the conversation totally.

excellent point John.

I think the study is innovative and fascinating and the chart puts a face on the conflict of interest many brokers just don’t seem to know what to do about. OK to ask where the data comes from and how reliable it is. Basic essential inquiry, but quoting NAR as an alternative source of reliable information continues to beg the question as far as I’m concerned.

NAR just hasn’t earned the rep yet as far as I know. Did NAR gain something other than membership that I’m not aware of?

This exact argument was proposed in Freakonomics by Levitt and Dubner. Brokers generally keep their houses on the market longer (I think Levitt said at least 10 days) than their clients’ because the benefit to them is greater when they are the ones that own the property.

On a related note, Superfreakonomics comes out next month!

“In my 23 years of interacting with brokers in my appraisal work, in a number of housing markets, I have found that the sellers generally hold sway over the brokers. The idea that the seller simply accepts the broker’s price recommendation is not real world. Of course there are good agents and bad agents just like any profession.

In fact, the sellers are armed with a lot more information than ever before – a lot of it is incorrect or misleading and in my experience, causing sellers to be less reliant on the agent’s initial advice.”

Yes, my owner who is my client, becomes my boss. I go in with my marketing plan and leave with the owners marketing plan. Exactly right also that the sellers are armed with more information then ever and feel that they are at least on par with brokers. Whether or not the abundant information applies, it’s still case by case, is another matter.

And that remains our business model. It’s more of the same but now we need to be better informed, at least a step ahead, and able to deal with and effectively counter the misapplied , misread market information.

Sometimes it’s as if the seller would like the broker to prove that they can out perform them and that’s what we increasingly need to do.