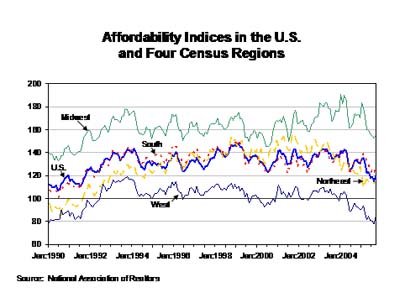

In David Berson’s weekly commentary this week he discusses how [housing affordability falls as rates and prices increase [Fannie Mae]](http://www.fanniemae.com/media/berson/weekly/index.jhtml).

There is an inverse relationship between mortgage rates/housing prices and affordability. Rates and prices rise, affordability falls. Nothing new here. You have less disposable income to buy other things or you don’t make the qualifying ratios in order to obtain financing.

>The NAR housing affordability index measures the share of the median-priced house (as defined as the median price of existing single-family homes sold in the monthly NAR home sales survey) a family earning the median income (as defined by the U.S. Bureau of the Census) can afford at the prevailing mortgage interest rate and using standard underwriting criteria. The prevailing interest rate is the effective rate on loans closed for existing homes from the Federal Housing Finance Board’s Mortgage Interest Rate Survey. The calculation also assumes an 80 percent loan-to-value ratio and a qualifying housing-to-income ratio of 25 percent.

These standards are a little outdated due to the 80% LTV and 25% ratio. There is a significant number of sales that relied on 90+% LTV’s and 33%+ H to I ratios. Ease of financing one of the triggers for the recent housing boom. Nevertheless, affordability was kept in check as prices increased because it was all about the monthly payment and not about the down payment.

What I find fascinating with the chart is the idea that affordability would be virtually the same today as this time 3 years ago had housing prices remained flat. If rates had remained constant, affordability would have dropped over the past 3 years.

In other words, the rise in housing prices is the bigger culprit in declining affordability, not the uptick mortgage rates.

Its an interesting concept because I am often asked what the mortgage rate threshold is before it causes a correction. I have been unable to come up with an answer I am comfortable with and perhaps this is why.

_[Note: Berson’s links lasts one week. After 9/6/06, go here and search for his 8/28/06 post.](http://www.fanniemae.com/media/berson/weekly/archive/index.jhtml;jsessionid=M41NEMFNU4ZOVJ2FQSHSFGA?p=Media)_

4 Comments

Comments are closed.

Also in the article, Berson mentions that, over the coming months, affordability will improve, as prices go down, and earnings go up.

Unfortunately (for sellers, and for real estate agents on commission), I don’t see this improvement as bringing in many more buyers. Which is both obvious and strange. As prices go down, potential buyers will be afraid that prices will drop more, and that 1) they are paying too much and 2) they won’t be able to sell their home, further down the line. Therefore, they’ll continue to wait on the sidelines until … well, until I don’t know when.

I’m very interested in seeing how it all works out, not just for self-serving interests, but also because I think it will show how the average person’s behavior is affected by things such as price and perception.

You mean herd mentality, I believe.

Just a note to say I really like your blog, and you’re doing a great job. I’ve also been using Seeking Alpha’s write ups of the housing market, and thought you might also find them useful.

Of course it is no surprise that consumer decisions are based on the afforability of the monthly payments —- cars, cable, parking, home ownership.

Regardless how you calculate it—higher price x lower rate or lower price x higher rate, the number that comes after the = sign is what consumers measure against take home pay & other expenses to see if they can afford it.

Until I can see the data that factors in the monthly payments under various price/rate scenarios I cannot accept the conclusion that higher prices alone affect affordability more than upticks in rates. What comes after the equal sign is what counts, all other things being equal (eg. wages, unemployment rate, inflation, rents).

With that said, affordabilty may not be the only player on the field. I support John K’s assertion that perception affects buying behavior. When prices were rising people wanted to buy perceiving the prices would rise even further (works for gas prices–i filled up every time thinking tomorrow’s price would be higher). And when prices fall, there is hesitation thinking that waiting will get you a better deal (works for plasma tvs and expensive electronics).

With that said, I would be tempted to conclude that quickly rising prices increase sales (panic demand) and falling prices decreases sales.