I’m a big fan of Michael Lewis’ writings starting with Liar’s Poker (think onion cheeseburgers for breakfast and traders owning more speed boats than suits) and much of his other work including Money Ball, Panic (a collection of his favorite news accounts of the credit crisis) and The Blind Side (Academy Awards), but I am very much anticipating reading his new work “The Big Short: Inside the Doomsday Machine.”

Admittedly I am growing weary of Wall-Street-what-went-wrong books and I still need to read Andrew Ross Sorkin’s “Too Big Too Fail” compendium on my nightstand (worrying its becoming “Too Big To Read”) but I definitely will. But the Lewis book has got my attention for some reason. It’s weird to sound like I am recommending a book I haven’t purchased or read yet but I guess I am relying on past experience.

In the book acknowlegements, the WSJ Deal Journal blog points out that Lewis:

>praises “A.K. Barnett-Hart, a Harvard undergraduate who had just written a thesis about the market for subprime mortgage-backed CDOs that remains more interesting than any single piece of Wall Street research on the subject.”

And my favorite quote referring to the idea of making the numbers say what you needed them to say.

>“If you just randomly start regressing everything, you can end up doing an unlimited amount of regressions,” she said, rolling her eyes.

She was able to track down information and cover the looming CDO disaster completely on her own through basic research.

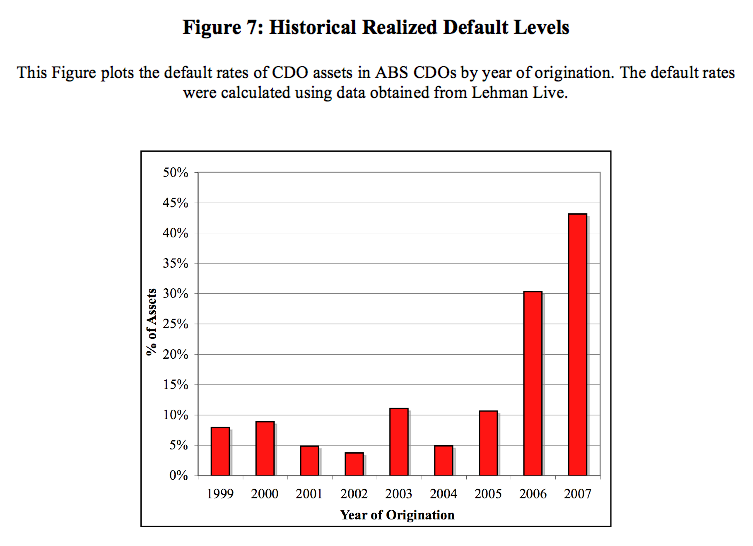

>Perhaps most disturbing about these losses is that most of the securities being marked down were initially given a rating of AAA by one or more of the three nationally recognized credit rating agencies, essentially marking them as “safe” investments.

A lot can be said for taking a detached or neutral look at a complicated situation. Sometimes the collective mindset takes on blinders, or in this case, blind folds.

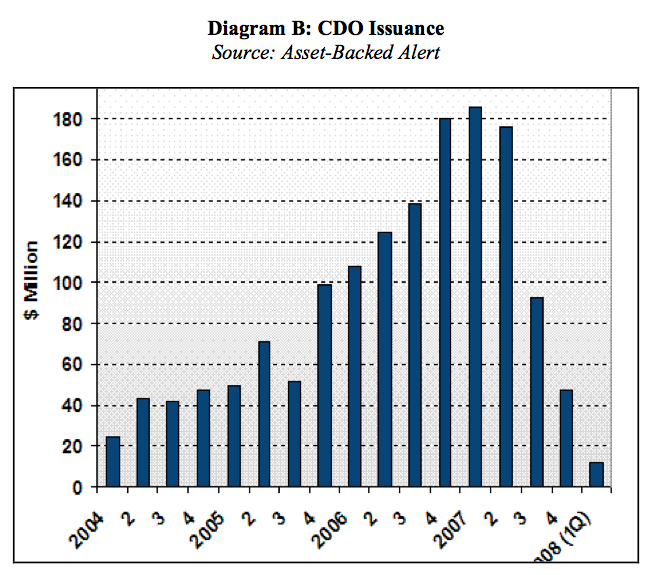

A couple of charts to peak your interest.