PMI releases its [Economic and Real Estate Trends quarterly report [PMI]](http://www.pmigroup.com/lenders/eret.html). Its “a narrative publication based on an internally developed PMI model. Issued quarterly, the report includes commentary on the national economy and regional housing price trends. In addition, select metropolitan areas are analyzed. The 50 most populated metropolitan areas are featured in a tabular presentation (Metropolitan Area Economic Indicators), based on a statistical model utilizing economic data, real estate variables and market expertise. The model provides several risk measures to gauge relative residential lending risk.”

[Download Report [pdf]](http://www.pmigroup.com/lenders/media_lenders/pmi_eret06v1s.pdf)[Download Appendix [pdf]](http://www.pmigroup.com/lenders/media_lenders/pmi_ERETappndx_06v1.pdf) [The report is based on the premise [MW]](http://www.marketwatch.com/tools/quotes/newsarticle.asp?g=AC0C1DEEE8F4460C9E1576E028C8C812&siteid=mktw&dist=nbk) that since appreciation was lower in the third quarter (They use OFHEO 3rd quarter data) the housing boom is over. They also indicate that mortgage rates are going up. Remember, a big chunk of the “sales” data in the OFHEO reports are [not based on actual sales data, but rather refinance data [Matrix]](http://matrix.millersamuelv2.wpenginepowered.com/?p=95).I am not arguing that the market is not seeing lower appreciation rates, and the risk of higher mortgage rates, however there does not seem to be any analysis in the report to support such statements and its the lead-in to why lenders should encourage borrowers to take out PMI insurance.

In other words, this seems to be more of a direct marketing piece than a research tool. In addition, there is no explanation on how the internal model was derived or what the logic is. How can this report be relied on?

_See_[Chicken Little Uses PMI Insurance [Matrix]](http://matrix.millersamuelv2.wpenginepowered.com/?p=179)

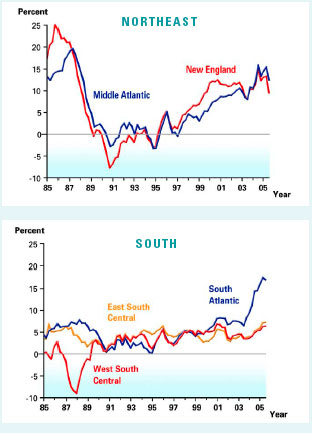

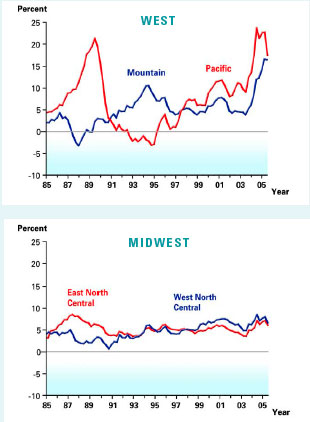

OFHEO 3Q 2005 Housing Appreciation