Here are the salient points:

* Appreciation remains positive in the nation’s 50 largest markets.

* 34 markets experienced reduced appreciation rates.

* Affordability decreased in more than half of the 50 markets.

* All but 4 markets showed employment growth. (Detroit and Warren, MI; Milwaukee, WI; Cleveland, OH did not).

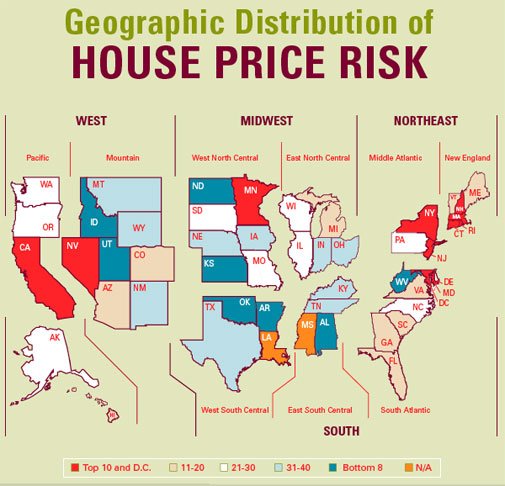

* The coasts are most risky – California and Northeast have 13 highest risk markets.

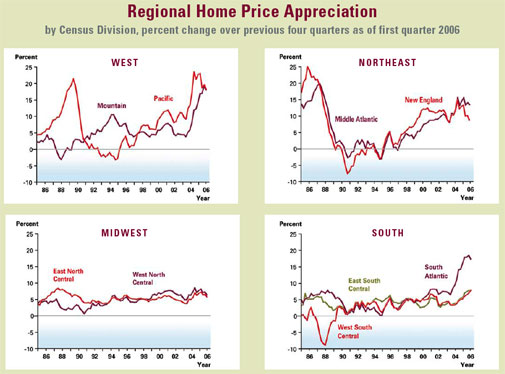

* West coast has highest appreciation.

* Affordability improved in 5 markets in Texas and 6 in Midwest.

There’s also a great table in the report that provides the best and worst senarios for mortgage payments.