This quarterly market report is provided by Dr. Kevin Gillen, an economist and Research Fellow at the University of Pennsylvania’s Institute for Urban Research. He analyzes the Philadelphia real estate market using the city’s real estate database through Econsult, an economics consulting firm based in Philadelphia PA that provides statistical & econometric analysis in support of litigation as well as business and public policy decision-makers. His results are published in a research paper called Philadelphia House Price Indices each quarter as a public service to the Philadelphia real estate community. Here’s his methodology.

Kevin does a great job parsing out the market and it is a pleasure to share his results on Matrix —Jonathan Miller

Download the report and Kevin’s commentary.

Here’s his recent press coverage on the findings.

>The most recent home sales figures suggest a slowing in the momentum of the housing market’s attempt to recover from its current slump.

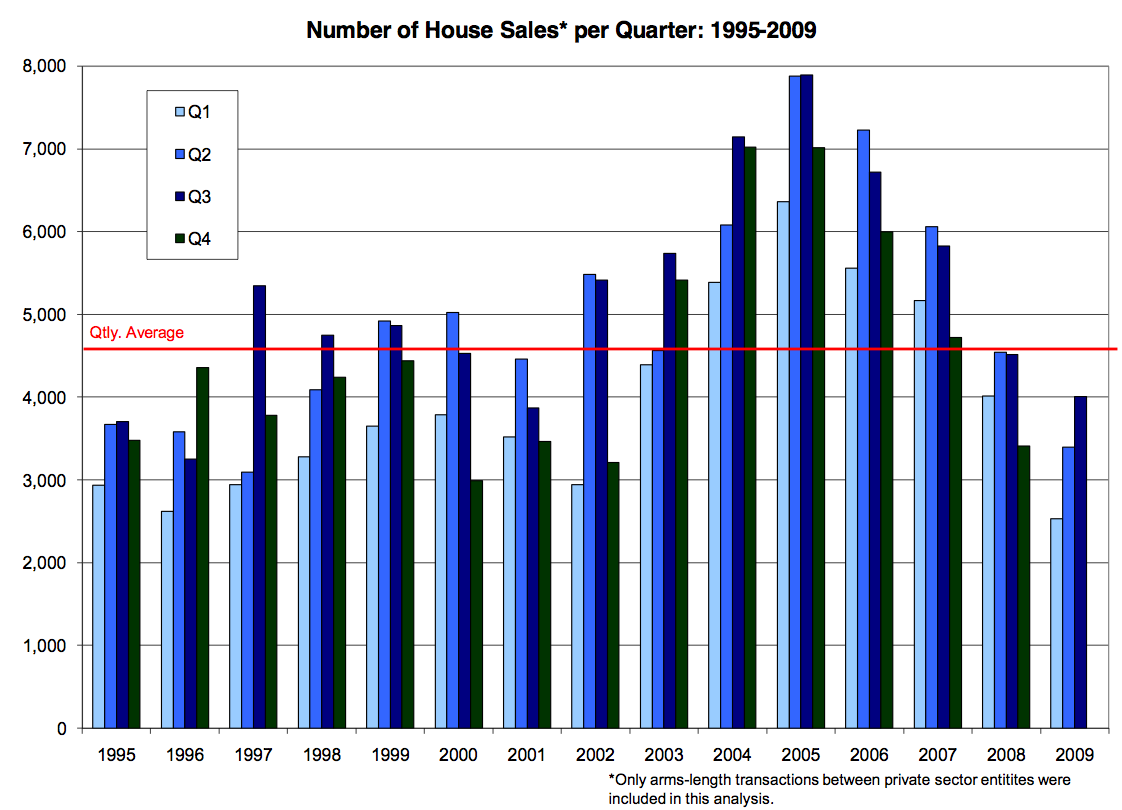

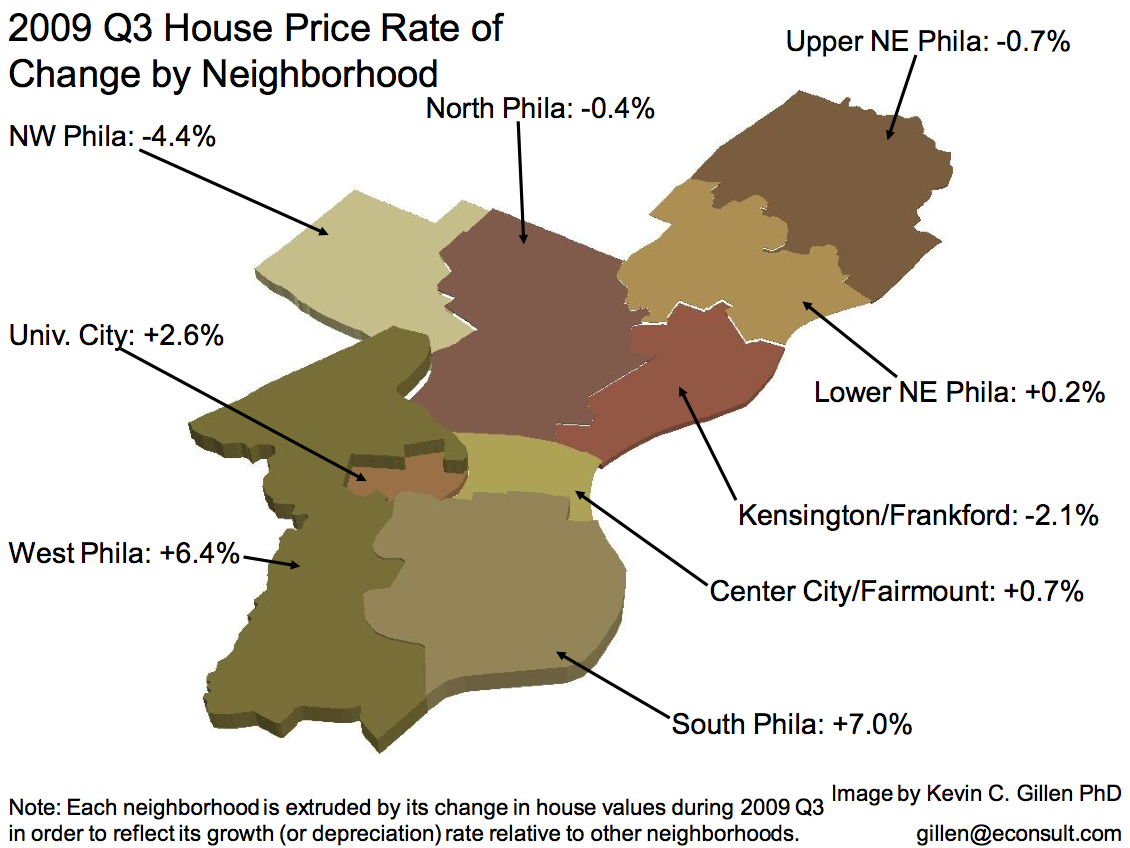

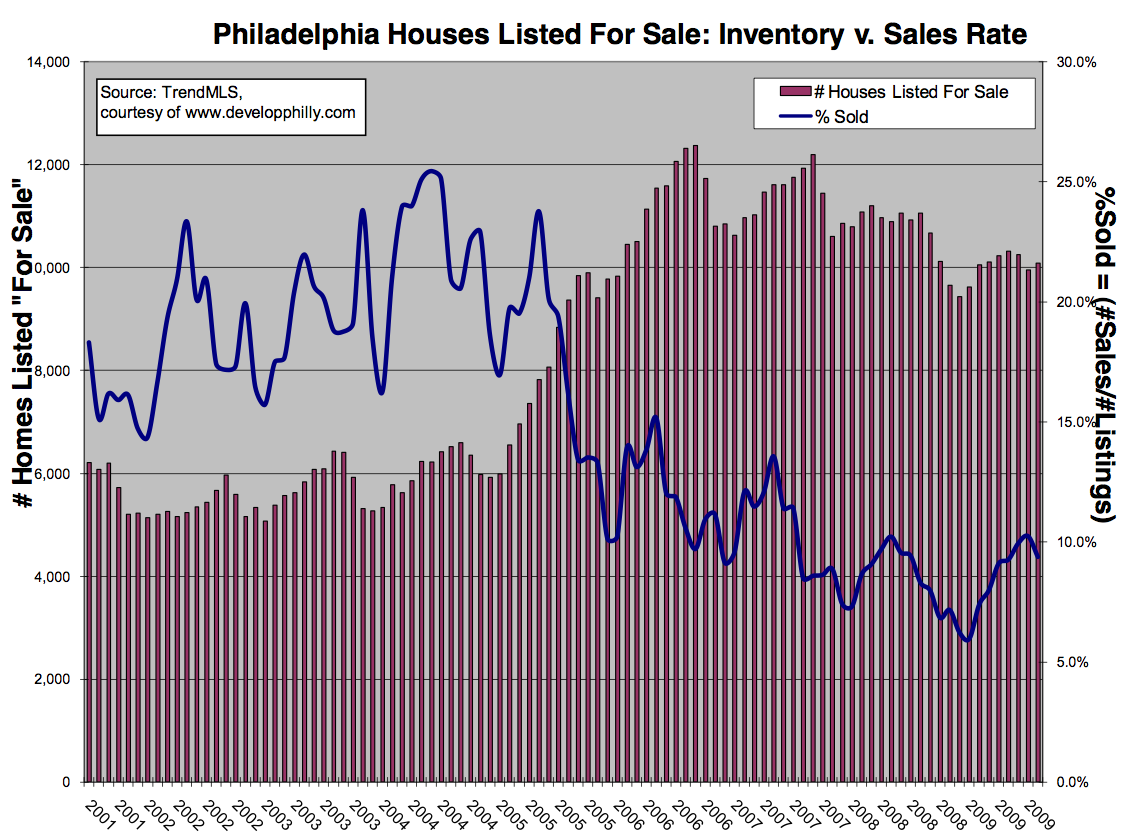

>Following the first quarterly increase in citywide house prices after two years of falling prices, the typical Philadelphia home rose in value by a scant 0.2% on a quality—and seasonally— adjusted basis this past summer, according to the latest analysis by Econsult economist Kevin Gillen. Following on the heels of a robust increase of 6.8% this past spring, Philadelphia house values appear to still be struggling to regain the value they lost over the past two years. With these losses in value netted against these two recent increases, the typical Philadelphia home has lost 8% of its value since the bursting of the national housing bubble over two years ago.

UPDATE: Greater Philadelphia Regional House Price Indices now available.

After experiencing the first increase in region-wide house prices in nearly two years this past spring, the Greater Philadelphia region slowed in the rate of appreciation this past summer. (November 11, 2009)

2 Comments

Comments are closed.

Only an 8% drop from peak? From looking at the other cities, I think we still have more to go. And the best part about this is we’re actually considered “undervalued”? Kinda think that’s a joke as well. IMO, the bar should be at “20% undervalued” according to the charts as “Fairly Valued” while Philadelphia, Baltimore, etc. should be considered Overvalued. The incomes are still not clearly there to support these home prices and unsold inventories are increasing. Our local market should not be in the same boat as Texas- they have a FAR better economy than ours. I also think we’re a lagging market. We’ve yet to see the chickens home home to roost here.

Interesting commentary – thanks! Although admittedly I get leery whenever someone refers to the “chickens coming home to roost.” What the %^^&%$# does that mean?