As a longtime reader of Housingwire, I always saw them as a great resource on the goings on in the mortgage industry. But lately, I grew concerned about the one-sided coverage as it related to my industry – residential appraisal.

HousingWire recently published an “appraiser shortage” blog screed that was tone-deaf to the problems facing appraisers. To their credit, Jacob Gaffney, the editor-in-chief, reached out to me for a rebuttal after reading all the negative appraiser feedback in the comments section. Rather than address specific failings of this piece, I opted to focus on current appraiser reality.

To start, the residential appraisal industry has a perception problem.

Read my full post on HousingWire.

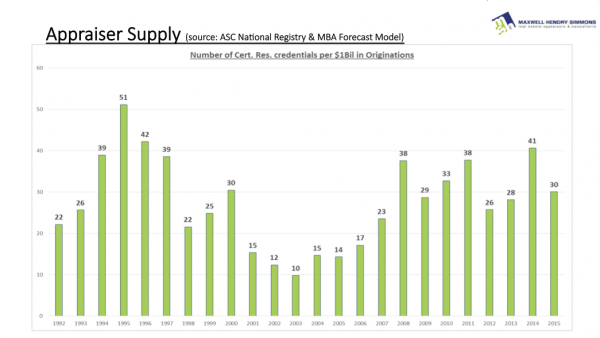

Here is another thought on this appraisal shortage silliness. Not too long ago there was a webinar hosted by Housingwire that included some Powerpoint slides by one of the panelists, Matt Simmons. He is a Florida appraiser and former state regulator. He shared it with me and one of his slides is quite amazing. He matched mortgage origination volume with the federal registry of appraisers.

The finding?

The ratio of appraisers to mortgage volume has been higher since the housing bust than during the housing boom. While the chart only goes to 2015, both total origination and appraisers have changed little since then, so the ratio would remain stable, consistent with the post-financial crisis pattern. In other words, there are more appraisers now than there were during the Housing Bubble based on mortgage volume.

UPDATE Full Housingwire Blog Post with Comments [PDF]

Comments are closed.