The NAR released their Pending Home Sale Index today for April which aggregates signed contract data for the month. It is generally 2 months closer to the “meeting of the minds” between buyer and seller than their existing home sale report, that is based on closed sales (and 4 months faster than Case Shiller).

Pending Home Sales Index is not “forward looking”

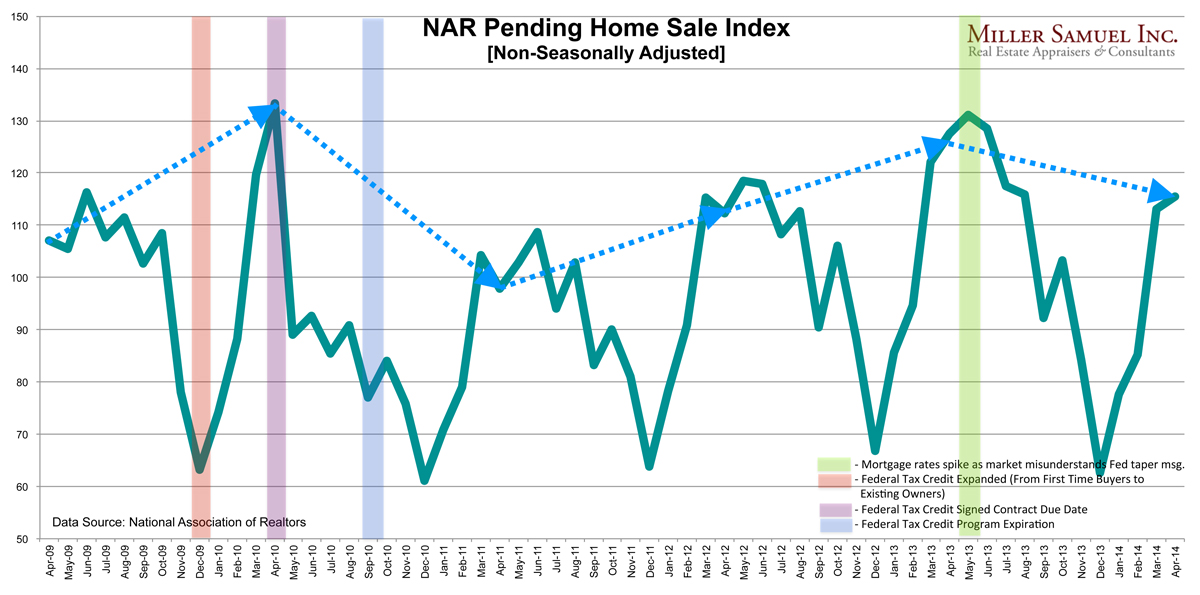

In my chart above, and if you know me, I hate seasonal adjustments (SA) in housing data so this chart uses NAR’s reported numbers without adjustments. NAR always frames this release series as “forward looking” when it really is “less backward looking” because it is based on contracts, not closed sales. The end of May report reflects April contracts, half of which were probably signed in Late March. With a 2 month spread between contract and closing dates, this report is the most recent US housing market snapshot but nothing about it is actually “forward looking.”

With all the weather talk and mixed housing market messaging over the last month, this release brought us a broad range of interpretation, from “plunging” to “edging higher.”

Well, which is it? Or could it be both? Yes it can. We just need context.

According to Housingwire (uses SA numbers): Pending home sales plunge 9.2% in April

So much for that post-winter, pent-up demand

Pending home sales for the month of April plummeted 9.2% compared to April 2013, the National Association of Realtors reported Thursday.

Contracts signed to buy existing homes increased 0.4% in April compared to March 2014, but that’s coming off three months of flat sales blamed on cold weather.

The expectation had been for at least a 2% gain month-over-month.

According to Diana Olick at CNBC (uses SA numbers), Pending home sales up just 0.4% in April, missing expectations

Warmer weather and higher expectations failed to cause a meaningful surge in home sales.

Signed contracts to buy existing homes increased just 0.4 percent in April, according to a monthly report from the National Association of Realtors (NAR). The expectation had been for at least a 2 percent gain sequentially.

The Realtors’ so-called pending home sales index is now 9.2 percent lower than April of 2013.

What’s going on?

If you look at the above chart you can see that last year’s pending home sales were surging up until May 2013, their highest level in 3 years (since the federal homeowner tax credit program as part of the stimulus). The surge in contracts in the first half of 2013 was born out of consumer fears that rates were going to rise. In addition, all the pent-up demand accumulated during the two year period preceding the US election and fiscal cliff deadline was released into the market. Many fence-sitters became decision-makers.

This winter’s harsh weather could have delayed buyers and we should be seeing this uptick in activity by now. We probably are seeing it but it no match for the year ago surge in activity but now the market is being characterized as weak or weakening. The problem with that description is it assumes that 2013 was a normal trend of an improving market. Well it wasn’t.

So yes, sales are down from the 2013 sales surge anomaly and the weather time-shifting buyers forward further into spring this year was no match for it. In fact, I suspect the next month will show the same type of “weakness” and the PHSI results probably can’t show real improvement at least until June.