David Berson, the chief economist who recently left Fannie Mae for PMI, authored an article in their Economic Real Estate Trends newsletter called “What is a normal housing market?”

>Over the past year, home sales have dropped by 22 percent, single-family housing starts have plummeted by almost 35 percent, and nationwide, home values have slipped by about 4.5 percent. Clearly it has been far from a normal year in the housing market, and 2006 was weak as well. On the other hand, the several years before these were just as unusual for housing, but from the opposite perspective. So, just what is a normal year for housing, and will we ever see one again?

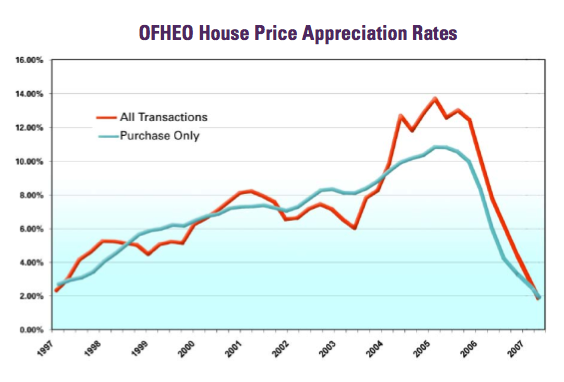

I think, more importantly than understand “normal”, how did the pressure for issuing mortgages increase the risk of housing market? It looks pretty substantial since non-arm’s length transactions far outpaced the market based on price.

By definition, OFHEO uses Fannie Mae and Freddie Mac data which is limited to mortgages of $417,000 or less and because its a repeat sales index, new development is excluded.

One of the charts posted in the newsletter showed purchases (blue) versus all transactions (red) [translation: red includes refi’s/homeequities/purchases]. Since the red line spikes well above the blue line in 2004-2006, and the red line data includes the blue line data, it illustrates that values of mortgage transactions that were not purchases, were significantly higher than the purchases to move the line that high.

Since non-sale transactions drove the mortgage business over this period and were not transactions driven by buyers and sellers haggling over price, it likely placed the housing mortgage market at greater risk. You can see the 2004-2006 period were all transactions were well above purchases providing an early warning to the mortgage market problems we are seeing now.

3 Comments

Comments are closed.

This is great.

It’s not complete, unfortunately.

For us all to draw comparisons and conclusions, we need “good” data.

As you mention, OFHEO only includes conforming loans.

This leaves out a lot of data … important data.

But, a good place to start, right?

Nice article

I don’t think the rise in reported prices created risk in the mortgage market. Sloppy underwriting created risk in the mortgage market. The same sloppy underwriting also allowed high declared prices to be used to loan a lot of extra money.

The divergence of the lines suggests a lot of refinance loans made with little evaluation of the quality of the collateral.

Banks that pressured appraisers to cook appraisals now get to eat their own cooking. Or maybe taxpayers will save the banks.