Mortgages have been the center of attention (ok, one of the centers of attention) as they relate to the housing market. The Mortgage Bankers Association (MBA), the major mortgage trade group [announced this week](http://www.mortgagebankers.org/NewsandMedia/PressCenter/46042.htm) that the first half of 2006 saw a drop in mortgage volume, with the exception of non-traditional products like interest only and option-arm products. Here’s a recap:

* 10% drop in purchase mortgages

* 22% drop in refinance mortgages

* 49% were first mortgages

* 33% were first time home buyers

* 32% rise in number of reverse mortgages

* 1% increase in second mortgage volume

* 19% ARM market share, down from 30% share

>”Long-term interest rates have remained low in the face of rising short-term rates, equity prices have risen nearly 20 percent, capital expenditures remain strong, the trade sector has turned from a big drag on growth to a modest stimulus and energy prices have dropped sharply,” Duncan said of his forecast for longer-term stability. [MBA chief economist Doug Duncan]

>The Fed likely will keep interest rates unchanged with the federal funds rate at 5.25 percent rate through 2008, the trade group predicts.

One of the reasons that the number of sales eased this year was the increase in mortgage rates – both real and perceived affordability. Its no surprise then that non-traditional mortgage applications have increased as purchasers seek to keep their payments in line with their incomes.

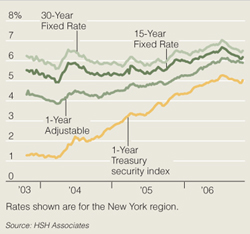

ARM mortgages helped fuel the housing boom and this year, their share dropped from 30% to 19%. Why? The spread between ARMs and fixed mortgages has contracted (do we hear inverted yield curve?) A stable fixed mortgage market is unlikely to increase the number of sales. In fact, affordability will suffer further as $1.1 to $1.5 trillion ARMs will reset in 2007. More than half of those are expected to move to a fixed rate product while the remainder do nothing.

[MBA forecasts fixed mortgage rates to remain at or slightly above current levels [MW]](http://www.marketwatch.com/News/Story/Story.aspx?guid=%7BCBA9CF5A-5D5B-4301-9890-70F8726AAEDC%7D&siteid=google).>Fixed-rate mortgages should remain at about 6.3% to 6.4% through the rest of the year, according to the most recent Mortgage Bankers Association forecast. Rates are expected to rise to about 6.7% by the end of 2007 and to about 6.8% by the end of 2008.

One of the byproducts of the drop in origination volume will be the shakeout in lending over the next year. [Too many lenders and mortgage brokers to divide up the pie. [LA Times]](http://www.latimes.com/business/la-fi-countrywide25oct25,1,7145934.story?coll=la-headlines-business&track=crosspromo) Lender profits are down as margins gets squeezed.

>Countrywide Chairman and Chief Executive Angelo R. Mozilo and his top executives outlined current troubles that largely boiled down to too many competitors chasing too few loans.

Mortgage applications tend to stagnate when mortgage rates are flat and it follows that housing would stagnate or weaken further until the inventory overhang is absorbed. However, the housing market is not just about fixed mortgage applications and their rates which is what the public tends to relate to. Its more about ARMs. The spread between ARM and fixed rate mortgages is much smaller today than a few years ago and that has been the impetus in the smaller number of mortgage and housing transactions.

Its cheaper to be more risky but less so today than before.