Every so often I include a guest post that stands out. It was written by my friend and colleague Constantine A. Valhouli, the co-founder and Director of Research for NeighborhoodX. I hope you enjoy it.

_____________________________________________

How racist and misguided planning put America in its housing crunch

How racist and misguided planning put America in its housing crunch.

Detail of Edward Hopper, “From Williamsburg Bridge”

Constantine A. Valhouli | August 15, 2017 12:31 PM

Real estate markets are cyclical, and prices appear to be near the peak of this cycle. But prices have not risen evenly across U.S. real estate markets. The biggest gains have been concentrated in the major cities, and often concentrated to a few neighborhoods within those cities. That said, the housing prices in these cities have largely outperformed the towns around them, and have risen significantly faster than most of the commuter suburbs.

However, what is happening right now – a sustained rise in city real estate prices – may not be a part of the regular real estate cycle.

Instead, the two-decade long rise of housing prices in some city neighborhoods may be driven in part by the gradual correction of effects from the misguided and racist urban planning policies like redlining and racist covenants. In these neighborhoods, prices for historic housing stock are pulling closer in line with those for adjacent neighborhoods.

In addition, neighborhoods hit hard by redlining retain their historic architecture and have one path to recovery. The neighborhoods affected by urban renewal have a different path to recovery – one driven by new development, where the upside goes to developers rather than to individual owners.

A Boston neighborhood that was under radar in 2000 is now asking up to $900/sq.ft.

65 Lewis St. in East Boston via RedFin

The diverging housing prices of cities and suburbs

To use Boston as an example, between 2000 and 2015, prices per square foot rose 12-185% depending on the neighborhood. A prime neighborhood like Back Bay increased 131%. But the biggest gains went to city neighborhoods that had been under the radar in 2000: South Boston (+185%) and East Boston (+152%). By contrast, housing prices in the surrounding towns increased much more modestly, and the commuter towns increased only marginally by comparison.

This pattern has played out in other major cities, too.

“The gains seemed to be driven by some combination of proximity to core neighborhoods, transportation hubs and a housing stock conducive to conversion,” said Jonathan Miller of Miller Samuel.

In addition, one of the reasons for the dramatic price increases in neighborhoods like South Boston and East Boston is that the starting points were so low. For a neighborhood where the average price is, for example, $200 per square foot, an increase of $100/sq.ft. represents a 50% increase. On the other hand, for an established neighborhood with an average price of $800/sq.ft., an increase of $200/sq.ft. only represents a 25% increase.

On one hand, the real estate data tell a story of diverging paths of major cities and suburbs: how cities could become considerably more affluent across neighborhoods, and how both poverty and the middle class might be pushed to the suburbs.

Above all, this data offers a chance to examine the urban planning and policy decisions that contributed to the decline of city real estate prices decades ago and simultaneously propped up the prices in the suburbs – and how these trends have been gradually reversing. But why?

Perhaps what we have been seeing isn’t a dramatic rise in housing prices so much as a return to the intrinsic value of historic neighborhoods that had once been desirable places, before poor planning and policy decisions artificially reduced their value.

If this is the case, then housing prices in major cities may continue to rise much higher and faster than those in the suburbs.

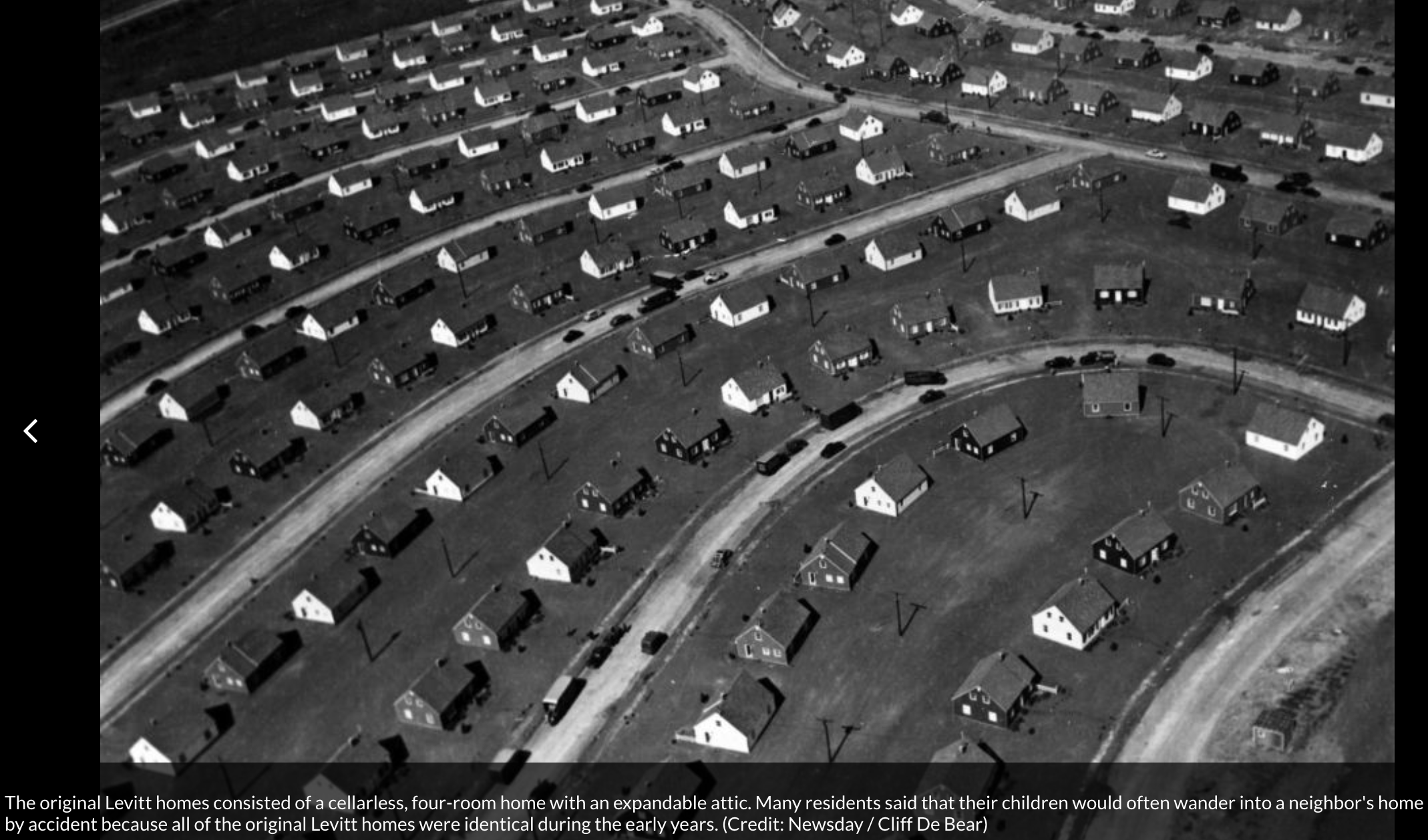

Levittown was the archetypal model for post-World War II suburban development – including the shameful racial covenants restricting sales to whites only.

Did policies like redlining and urban renewal depress values in parts of cities – and subsidize values in some suburbs?

In order to understand why housing prices may rise further in these cities and comparatively lag in the suburbs, it is important to first understand the adverse effects that misguided urban planning policies had on cities from the 1950s to the 1970s. Specifically, how redlining, racially-restrictive covenants, and urban renewal affected neighborhood housing prices for decades – and what this means for us today.

Until World War II, American cities resembled European ones in that wealth was largely concentrated in the urban core. However, in the decades after World War II, the United States pursued policies that in hindsight were both misguided and racist – but which centrifuged affluence outwards and concentrated poverty in certain city neighborhoods.

Collectively, these policies blighted many city neighborhoods and simultaneously acted as a subsidy for the suburbs. More importantly, these policies served as what economists call ‘market distortions’ by artificially depressing prices in some neighborhoods of major cities, and boosted prices in some suburbs. These price distortions partially set the stage for the real estate bargains of the 1980s and 90s, as well as the meteoric rise of property values since then – not to mention the important questions over gentrification and displacement we’re facing today.

But these policies affected neighborhoods in different ways – and this in turn affects how (or even if) the neighborhoods will recover their intrinsic value. Looking at Los Angeles, New York, and Boston, some historic neighborhoods affected by redlining seem to have recovered far earlier than neighborhoods that were reshaped by urban renewal.

Let’s examine these policies.

Restrictive covenants were clauses in the bylaws or deeds of a building or housing development which prohibited the sale of the property to minority or Jewish buyers. These clauses were also used to preserve the whiteness of many suburbs. At the same time, at the federal level, banks were encouraged to pursue a policy of redlining that made it almost impossible to get a loan in a city neighborhood that was too racially diverse, because it was deemed ‘too risky.’ There was literally a red line drawn around certain neighborhoods on a map, and no loans were made within this area. The policy was, at its core, segregation.

Lastly, urban renewal was a euphemism for the wholesale demolition of historic downtown neighborhoods. For the affected neighborhoods, urban renewal resulted in permanent and unwelcome change. Historic houses were replaced by dense housing projects and the street grid was often de-mapped for de-humanizing megablocks – and both of these planning strategies have been since discredited. Adding insult to injury, highways were often run through these neighborhoods – causing air and noise pollution, as well as higher asthma rates for generations of poorer residents.

In many ways, this clash of ideologies was symbolized by the confrontation between visionary urbanist Jane Jacobs and misguided and racist planner Robert Moses. Jacobs valued neighborhoods and a bottom-up approach to planning, one that involved the residents of a place. Her Death and Life of American Cities offered a scathing and well-reasoned critique of Moses’ city-scale, top-down, and racist urban planning. For example, in order to restrict minority access to the suburban beaches, Moses intentionally designed the bridges too low to permit buses, thus restricting the beaches to the mostly white, affluent families who could afford a car.

For decades, these policies distorted the living conditions and real estate prices for entire neighborhoods. Furthermore, by creating concentrations of poverty, they caused ripple effects that were felt for years.

In a formerly redlined neighborhood like Crown Heights, architecture like this helps spur revival. | 982 Sterling Place via Corcoran

Did redlining and urban renewal affect housing prices differently?

Today, the central question is whether city neighborhoods affected by redlining are reviving differently from those affected by significant urban renewal.

In the last two real estate cycles, prices in many of these city neighborhoods have been rising. Perhaps what we’re seeing now isn’t speculation or gentrification, but simply a return of many neighborhoods to their inherent value as they repair the damage from these misguided policy decisions – at least the neighborhoods that are able to do so.

Redlining generally did not affect the architectural fabric. Redlining led to disinvestment, but most of this neglect can be fairly easily repaired. Neighborhoods that remained architecturally intact are likely to see housing prices improve for the existing buildings. By contrast, the damage done by urban renewal is often so significant that it renders the land more valuable than the buildings.

Redlining and racial covenants temporarily affected living conditions but not the underlying architectural fabric. As a result, the neighborhood may have desirable historic buildings which can be purchased for a fraction of the price of other, more established neighborhoods nearby. In New York City, this was the pattern seen in the revival of Brooklyn Heights and Park Slope, and more recently in Crown Heights and Bedford-Stuyvesant.

But at the time, and for decades later, these policies enforced segregation and created economic ghettos. This in turn created other problems which changed the daily experience of living in the neighborhood.

For example, in a healthy city neighborhood, street-level retail commands a significantly higher price per square foot compared to residential space. However, the concentration of poverty and the lack of disposable income caused landlords in these neighborhoods to convert valuable retail spaces into makeshift apartments. In turn, the lack of retail made the streets less lively and more dangerous, creating further downward pressure on housing prices. At the time, properties near certain city parks were regarded as less valuable because the parks were so dangerous. In a healthy real estate market, these properties should command a higher price for the park views and access.

As a result of the effects of these policies, many city neighborhoods regressed from neighborhoods of choice (places where people aspired to live) to neighborhoods of necessity (places where people lived only because they could not afford to live elsewhere).

However, many neighborhoods affected by redlining and disinvestment retain the qualities which have made them inherently desirable. People are drawn to traditional, walkable neighborhoods with attractive historic housing and a potentially lively mix of uses at street level. While these core qualities that were devalued during the mid to late 20th century, thoughtful urban planners are trying to encourage the development and restoration of these neighborhoods today.

Neighborhoods hit hard by urban renewal require institutional-level investment to recover. | Brush Park, courtesy of City of Detroit

Neighborhoods hit hard by urban renewal have a different path to recovery

On the other hands, neighborhoods affected by urban renewal have a different – and more difficult – road to recovery.

The planners of the 1950s-70s demolished the very historic buildings and walkable, human-scale streets that have helped other traditional neighborhoods revive. These lost buildings would have been a natural catalyst for the neighborhood’s revival, and would have needed only a comparatively modest investment to do so. Instead, these neighborhoods were destroyed by institutional-scale planning and will require institutional-scale investment to revive. These neighborhoods will likely never recover their previous charm, but it is possible – with tremendous vision and care – to transform them into something new and desirable.

The historic neighborhoods which escaped urban renewal offer a glimpse of where prices might have been if other, comparable neighborhoods had remained intact.

In the 1960s, planners would begin the urban renewal process by designating certain neighborhoods as ‘slums’ as a pretext for the need for demolition. The neighborhoods which successfully fought the slum designation, like the West Village in Manhattan and the North End in Boston, are today among the most valuable neighborhoods in their respective cities.

In an effort to spur demolition, Robert Moses declared Greenwich Village ‘blighted’ and a ‘slum.’

The existing buildings now command some of the highest prices for Manhattan real estate.

However, whereas the upside in intact historic neighborhoods goes to individual homeowners, the potential housing gains in a neighborhood leveled by urban renewal are often driven by the land value and rezonings that benefit developers rather the homeowners.

The neighborhoods hit hard by, or entirely demolished by, urban renewal were positioned as development opportunities at the time. But it took decades for that land to become a compelling opportunity for development. The same policies which demolished these neighborhoods encouraged residents to leave for the suburbs, making that urban land less valuable. Ironically, the development opportunities did not become truly compelling until, ironically, the nearby intact neighborhoods recovered in an organic manner.

Comparatively stagnant housing prices in the suburbs

There is a significant contrast between the rise in housing prices of the major cities since 2000, with the comparative stagnation of the suburban housing prices during the same period. According to Jonathan Miller, “Suburban counties outside of New York City have underperformed Manhattan price trends since 2000. For example, Westchester County housing prices increased 62.7% from 2000 to 2015, trailing Manhattan which more than doubled. And no towns in Westchester experienced four-fold gains observed in some Manhattan neighborhoods.”

The same policies that damaged housing values in cities also artificially boosted values in many post-war suburbs. And just as housing prices in certain urban neighborhoods are rising as the price-distorting effects of these racist policies wears off, housing prices in some suburbs may be returning to their intrinsic, lower levels.

The phrase “white flight” is often used to describe the shift in preference from city to suburb after World War II, but the phrase doesn’t convey the nuances of how things actually happened. There were massive systemic mechanisms in place that made it difficult for white buyers to purchase in walkable city neighborhoods that were diverse, partially in order to drive demand for the new suburbs that were being developed as a result of the highway system.

The current shift in preferences from suburb to city is driven in part by the recognition that many suburbs have inherent drawbacks: long commutes as well as a lack of walkability, restaurants, nightlife and a sense of community. For years, redlining steered white buyers to the suburbs by prohibiting them from purchasing in diverse, urban neighborhoods. This stimulated demand for what might have otherwise been a less desirable alternative. The stagnation of suburban prices since 2000, particularly in contrast to the increase in value of walkable city neighborhoods, reflects that for many buyers, the decision to live in the suburbs is one of economic necessity rather than choice.

The diverging housing values of the cities and the suburbs raise some important questions.

Going forward, what are the implications for residents of the suburbs and commuter towns? Will they be able to sell their place in the suburbs and buy into the city, thus tapping into the opportunities for upward mobility through better education and job opportunities?

Certain suburbs may fall victim to the same misguided and racist practices which affected less-affluent city neighborhoods during this time.

Under these policies, city neighborhoods that lacked political clout became the site for contentious projects, including infrastructure (incinerators, municipal dumps, trash transfer stations, and wastewater treatment plants) as well as concentrations of public housing.

In New York City, sections of the Rockaway peninsula, a former beach resort, were demolished for a massive low-income housing complex. The area was wholly unsuited to public housing, given an hour-long commute to midtown and the lack of job opportunities nearby. Decades later, that section of the Rockaways has the highest concentration of poverty, the lowest-income census tracts, and among the highest rates of violence in New York City.

As major cities become more desirable and more affluent overall, poverty and the working class are being pushed out to the suburbs. And as certain suburbs become poorer and less able to organize effectively, they may find themselves in the same position as the Rockaways.

For example, when Rudolph Giuliani served as mayor of New York City, he externalized the issue of homelessness to the suburbs by offering one-way tickets for the city’s homeless to Brideport, Connecticut. He did not address the issue in a meaningful way, he simply created conditions that led to a sharp rise in poverty, violence, and a need for social services in Bridgeport.

Conclusion

The diverging price trajectories of cities and suburbs could become a major issue. Cities appear to be recovering their intrinsic value, and are becoming more expensive, even in outlying neighborhoods. At the same time, suburbs are falling behind in value and desirability. What was once a sign of the American Dream is now a neighborhood of necessity rather than one of choice.

But for those who live in the suburbs and are hoping that a market correction may provide an opportunity to sell there and buy in the city, this may not necessarily be good news. [if the suburbs have been this stagnant in price during a strong market, what will happen when the markets correct as they inevitably will]

Going forward, what are the implications for residents of the suburbs and commuter towns? As prices diverge, selling a 2,000 square foot house in the suburbs might only buy a one bedroom apartment in the city. It may be increasingly difficult for those in the suburbs to access opportunities for upward mobility through better education and job opportunities found in cities.

It is difficult to judge decisions of another era by the standards of our own. But the racism that underscored redlining and much urban renewal created a shameful legacy of economic, social, and health repercussions that we are still struggling to understand and address today.

Constantine A. Valhouli is the co-founder and Director of Research for NeighborhoodX.

Comments are closed.