I know there are a lot of problems in the world right now, but its been a while since I’ve mentioned extreme ironing. A word from the inventor:

And a variation – wait for it:

And another:

Now admit it…you feel better.

See you next week!

But I digress…

Market Update: The Collapse of Residential Listing Inventory Defines U.S. Real Estate

My recurring “Market Update” column appeared in Douglas Elliman Magazine for their Fall 2022 edition. I looked at the markets we cover to compare the pre-pandemic inventory levels to current levels. Only Manhattan showed supply over pre-pandemic, while most other markets were down sharply. While the percentage gains in supply we see sound high, they are coming from an unusually low place.

The Meaning Of 1-to-23 1/2: A Residential Super Tall Literally Has To Sway

111 West 57th Street (Steinway Tower) is called the “most slender skyscraper in the world” because of its width to height ratio: 1-to-23 1/2. Here are some other rankings by the Skyscraper Center.

“Any time it’s 1-to-10 or more that’s considered a slender building; 1-to-15 or more is considered exotic and really difficult to do,” SHoP Architects founding principal Gregg Pasquarelli said. “The most slender buildings in the world are mostly in Hong Kong, and they’re around 17- or 18-to-1.”

One of my NYC fantasies would be to Airbnb a top-floor apartment for an evening at 111 West 57th Street, a new super tall on Billionaires row, with an impending Cat-5 hurricane and associated high winds.

I oscillate back and forth on whether I would actually do it since I suffer from severe motion sickness. It’s a beautiful structure, and I’m sure the views are incredible but I’d likely need plenty of Dramamine.

My idea became credible after I read about this supertall in Bloomberg: A Look At the World’s Skinniest Skyscraper: Steinway Tower

(in the following, bold is my emphasis)

Steinway Tower is so skinny at the top that whenever the wind ramps up, the luxury homes on the upper floors sway around by a few feet.

Here’s a rendering from the YIMBY website.

Compass Has A Cash Burn Problem

For the past eight years or so, I’ve been doggedly writing about the fallacy of the Compass business model and their disruption by capital efforts. They have some of the best real estate brokers in the business and my criticism is not levied against them in any way. If the company doesn’t survive, agents can move to other companies and most will be gladly welcomed.

My criticism is specific to the Compass business model. My disbelief in the model specifically began with their positioning as a tech company, presumably to get a much higher valuation than a traditional brokerage firm. But as I’ve shared in the past, my conversations with employees who have left or were interviewed told me the same thing I could see from the outside, it’s a traditional real estate brokerage company.

If I was a company like Softbank, not known for their due diligence (think WeWork) and gave a billion in cash to some innovative non-real estate people without any initial pressure to create a sustainable business model (make a profit), a disrupter would be born often referred to as a unicorn. A startup paying cash bonuses for recruitment and giving higher fee splits than the local market would certainly attract independent contractors. So would white-labeled off-the-shelf brokerage software that was well put together in the guise of cutting-edge tech. In other words, the differentiation with competitors is an unsustainable advantage of unaccountable access to capital.

Wall Street was initially blinded by the rapid revenue growth of Compass from their deep misunderstanding of the real estate business. And until WeWork imploded to a shadow of its former self, most unicorns were not subjected to much scrutiny.

Compass failed to make money during one of the biggest housing booms of the modern era and have never made a profit. How will that work with much lower sales volume and seemingly high overhead? At some point, the party stops, and the cash runs out.

No one has done a better job at chronicling the Compass financials than Mike Delprete and all my Housing Note readers should be subscribed to his newsletter by now for all things real estate tech.

The Real Deal writes: Compass loses $101M; will no longer offer equity to new agents after Reffkin’s earnings call.

After the earnings call, Reffkin wrote to Compass agents, reiterating that the firm was committed to agent development and saying speculation from critics and competitors was “not new, not true, and not credible.”

“Let me be very clear,” Reffkin wrote in the email, which was shared with TRD. “Compass will not run out of cash.”

That last sentence was a highly unusual statement and likely a reaction to Delprete’s articles. To summarize the recent Compass survival moves that have analysts and the industry talking about:

– Lots of layoffs ahead for support staff, likely more than is being announced.

– Less favorable commission splits

– No more equity incentives for new agents

– Cutting ancillary services

– Reduced new market expansion

While they indicated that eliminating equity incentives had had no impact for the past two months, the market had sharply pivoted. Generally speaking, it was not a time to make a move.

Just look at the news from a Google search on the word “Compass.”

The Real Deal breaks it down for us:

My takeaway is that the path to profitability and adequate cash is conversion to traditional brokerage expense levels. This means they won’t be able to differentiate in their recruiting efforts because they no longer will have the cash without strings to disrupt, thereby proving their model is not sustainable. Disruption by capital is not a sustainable differentiator because the money eventually runs out.

Darrell Hofheinz of the Shiny Sheet Talks About The Surreal Palm Beach Market

The Palm Beach Civic Association has a video podcast with leading figures of Palm Beach and the production values are enviable. Darrell has made it his job to understand the transactions and real estate market like few people I have ever met in any market.

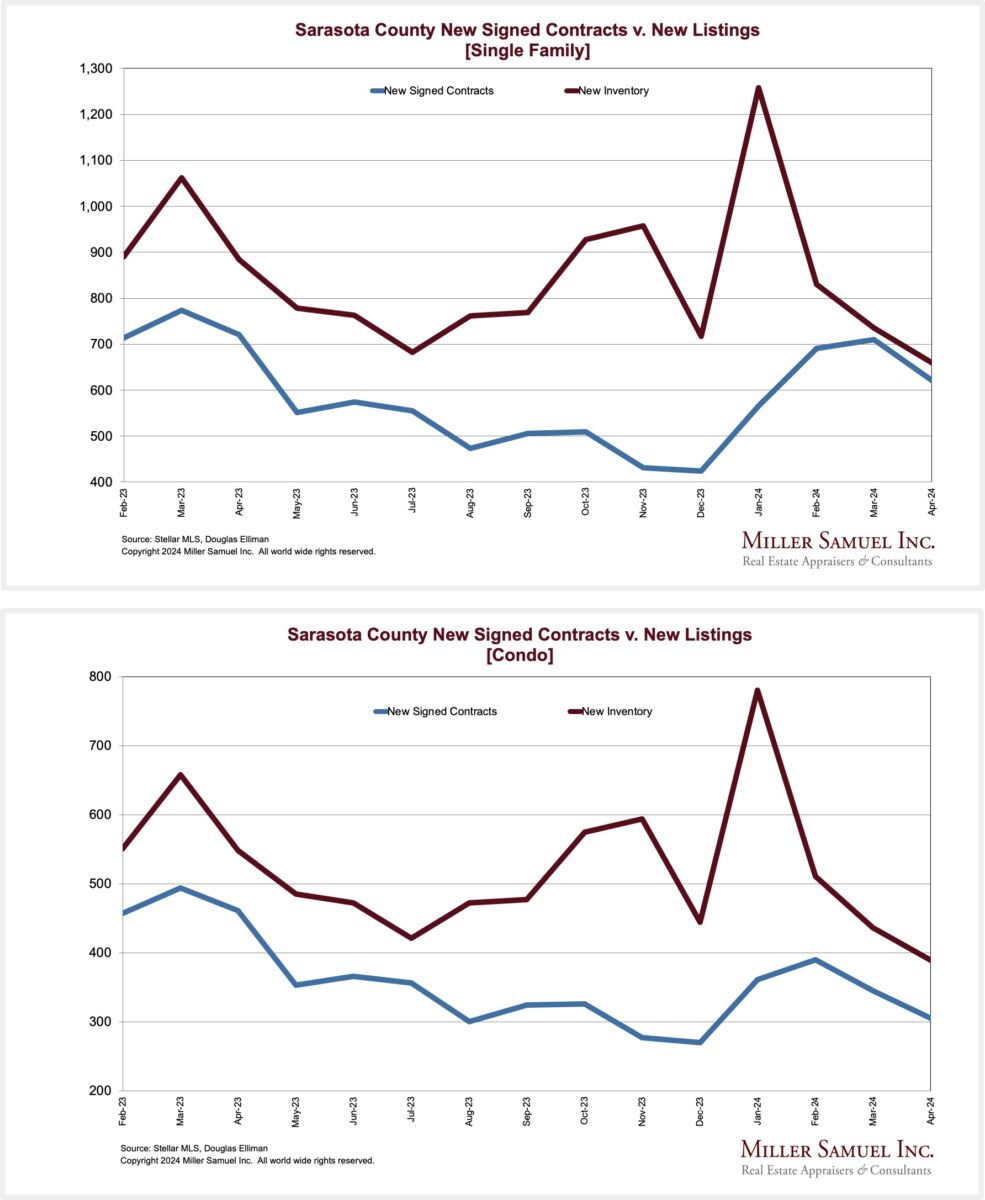

Getting Graphic

My favorite charts of the week of our own making

My favorite charts of the week made by others

Appraiserville

(For earlier appraisal industry commentary, visit my old clunky REIC site.)

TAF Terminated My Free, Public Email Subscription

Back in June, I noticed that I didn’t receive the monthly newsletter from Dave Bunton of TAF. I have been getting it by clockwork for years and never had an issue with it going into spam.

And then it did not come in June, July, August. I’ve gone to their website and signed up again, but nothing came my way. It’s not been a problem since many people have forwarded their newsletters to me.

But why would they do that? But then I realize this is the same organization that wrote the bat-shit crazy letter. Question answered.

When I get back from vacation, I will signup with an alias account. My guess is that their petty action relates to the chickenshit letter of May 26, 2022. It looks like Dave and Kelly showed me! Lol.

And now someone is trying to change my password. Paranoia runs deep at TAF these days.

USPAP Is Now Open Ended And No One Knows Why

Previously we have discussed the extension of USPAP through December 31, 2023, creating a four-year window without changes yet appraiser still have to take two 7-hour update courses during this period.

They noted in the press release that:

Future editions of USPAP will have beginning effective dates but no end dates to give the ASB greater flexibility to thoroughly examine proposed changes and respond in a timely manner to a changing marketplace.

What does this even mean? Once they fix the ethics rule, and the definition of “misleading” are among a handful of changes we’ve been waiting for, there won’t be a need to make any more changes for years. Does this announcement snuck into the release suggest this? So much for transparency.

Law Firm That Represents The Appraisal Foundation Represents The Victim In An Appraisal Discrimination Lawsuit

One of the definitions of being a “hipster” is that you have to always be searching for irony. And I am absolutely a hipster this week.

Dave Bunton, in the monthly TAF newsletters that he doesn’t want me to see anymore, inserts the word “preeminent” in front of the law firm Relman Colfax that are known for their fair housing work. He included the pre-fix so awkwardly as if trying too hard to state how good this firm is that I have nicknamed them Preeminent, Relman & Colfax.

When reading the New York Times article on the latest case of appraisal discrimination, Home Appraised With a Black Owner: $472,000. With a White Owner: $750,000 I noticed that the victims are represented by the same preeminent firm.

With TAF engaging this firm a few months ago, it makes me wonder why TAF has taken so long to establish an advisory committee for fair housing and civil rights representation and why they haven’t removed and re-written the fair housing module yet or disclosed any credible reasons for not moving more quickly?

What is the actual role of this preeminent firm?

OFT (One Final Thought)

My friend, chef, superstar, pragmatist, and highly respected real estate broker Paul Zweben of Douglas Elliman lays it out for us on Tiktok. My only challenge to the mantra he shares is that I wear an early version of the Apple watch, and I have no idea what it cost me. And don’t get me started about my diamond-encrusted sundial.

@douglaselliman Paul Zweben’s Top 5 Tips @The Zweben Team #nycrealestate #douglaselliman #top5 #trend #tips #newyorkcity #luxuryrealestate #fyp #foryou #trending #5things #5thingschallenge ♬ Love You So – The King Khan & BBQ Show

Vacation Time

We’re headed overseas for a three week vacation and won’t be thinking about housing as much as usual (at least that’s the goal). Housing Notes will still come out every Friday at 2 pm eastern but won’t be packed with a lot of content so you can take a break too.

Brilliant Idea #1

If you need something rock solid in your life (particularly on Friday afternoons) and someone forwarded this to you, or you think you already subscribed, sign up here for these weekly Housing Notes. And be sure to share with a friend or colleague if you enjoy them because:

– They’ll be more extreme;

– You’ll iron things out;

– And I’ll swear off real Rolex watches (while extreme ironing).

Brilliant Idea #2

You’re obviously full of insights and ideas as a reader of Housing Notes. I appreciate every email I receive and it helps me craft the next week’s Housing Note.

See you next week.

Jonathan J. Miller, CRP, CRE, Member of RAC

President/CEO

Miller Samuel Inc.

Real Estate Appraisers & Consultants

Matrix Blog

@jonathanmiller

Reads, Listens and Visuals I Enjoyed

- How to Investigate Your Next New York Apartment Like a Reporter

- Slowdown in Showings Suggests a Further Decline in Existing Home Sales in August

- 'Monster' home divides Hawaii residents amid housing crisis

- Palm Beach Daily News

- A Look At the World's Skinniest Skyscraper: Steinway Tower [Bloomberg]

- U.S. Home-Sales Report for July Comes as Housing Market Cools [Wall Street Journal]

- Holdout buildings NYC [Ephemeral New York]

- The history behind NYC's water towers [6sqft]

- The housing market is bad but not that bad [NY Times]

- Wells Fargo Backing Off Mortgage Market [The Real Deal]

- Apple Summons Employees Back to Offices Three Days a Week [Commercial Observer]

- The fabulously wealthy are fueling a booming luxury ranch market out West [Washington Post]

- Most homeowners still want yards — but pool craze wanes [Inman]

- Deeper Cuts Announced as Compass' Cash Burn Continues [Mike DelPrete – Real Estate Tech Strategist]

- Wealthy Americans are flocking to Florida [Fortune]

- 2022-23 Top Ten Issues Affecting Real Estate® (with Marilee Utter, CRE, and James Nelson, CRE) [CRE]

- US Home-Sale Cancellations Soar in July as Buyers Pull Back [Bloomberg]

- Resi Firm Compass lost $101M in Q2, Ends New Agent Equity [The Real Deal]

- Biggest US Real Estate Brokerage Braces for Its First Housing Downturn [Bloomberg]

My New Content, Research and Mentions

- ‘Screw This City’: There’s Never Been a Worse Time to Rent an Apartment in NYC [Bloomberg]

- A Hamptons Farmhouse Hits the Market After More Than a Century in the Same Family [Wall Street Journal]

- A Hamptons Farmhouse Hits the Market After More Than a Century in the Same Family [Mansion Global]

- Larry Ellison lists North Palm Beach home for $145M [Inman]

- As The Wealthy Return To Cities, Beach Resort Towns Are Left With A Housing Mess [Bisnow]

- Rental Rates in NYC Reach Record High After Covid Plunge in Pricing [The Jewish Voice]

- US Housing Crisis Continues [World Nation News]

- Analysis of NYC New Condo Inventory [The Real Deal]

- Mark Zuckerberg and Priscilla Chan Sell San Francisco Home for $31 Million [Barron's]

- Manhattan Rent Hits Record High [NTD]

- TRD Pro: Queens’ Priciest Home Sales in Q2 [The Real Deal]

- Long Island home prices aren't dropping as the real estate market slows. Here's why. & More Latest News Here [Up Jobs]

- Even in a Tight Market, Buyers Can Still Land Perks in New Developments [Mansion Global]

- Rental Rates in NYC Reach Record High with Eye Popping Rates; Living in Big Apple Becomes Unaffordable [The Jewish Voice]

Recently Published Elliman Market Reports

- Elliman Report: Colorado New Signed Contracts 7-2022 [Miller Samuel]

- Elliman Report: Manhattan, Brooklyn & Queens Rentals 7-2022 [Miller Samuel]

- Elliman Report: California New Signed Contracts 7-2022 [Miller Samuel]

- Elliman Report: Normandy Isles/Normandy Shores New Signed Contracts 7-2022 [Miller Samuel]

- Elliman Report: Florida New Signed Contracts 7-2022 [Miller Samuel]

- Elliman Report: New York New Signed Contracts 7-2022 [Miller Samuel]

- Elliman Report: San Diego County Sales 2Q 2022 [Miller Samuel]

- Elliman Report: Orange County Sales 2Q 2022 [Miller Samuel]

- Elliman Report: Malibu + Malibu Beach Sales 2Q 2022 [Miller Samuel]

- Elliman Report: Los Angeles Sales 2Q 2022 [Miller Samuel]

Appraisal Related Reads

- A Professor Who Studies Housing Discrimination Says It Happened to Him [NY Times]

- Pricing a Home In A Softening Market [Birmingham Appraisal Blog]

- The inventory myth & dipping prices [Sacramento Appraisal Blog]

- Advice for buyers & sellers in today’s housing market [Sacramento Appraisal Blog]

- THE CON: The American Dream Dies Where Power Lies [Bill Moyers]

Extra Curricular Reads

- Robert Plant and Alison Krauss on the secrets to aging gracefully [LA Times]

- Dodge will retire Charger and Challenger, its muscle car mainstays [Washington Post]

- The Church Left on the Curb [Curbed]

- Jake Plummer wants to live forever [The Athletic]

- Snoop Loopz Is the Latest Breakfast Food From Snoop Dogg [Nerdist]

![[27 Speaks Podcast] Jonathan Miller Provides A 2024 Hamptons Outlook](https://millersamuel.com/files/2024/02/27eastlogo-600x314.jpg)