We published our report on the Miami sales market for 4Q 2012. This is part of an evolving market report series I’ve been writing for Douglas Elliman since 1994.

Key Points

– SALES SURGE – Sales were up sharply from a year ago, the highest fourth quarter in at least 6 years.

– FALLING INVENTORY – Listing inventory fell sharply. Low or negative equity holding back supply in addition to higher sales activity.

– SMALLER DISTRESSED SALES SHARE – 40.2% market share of distressed sales (REO+Short Sales) lowest share in 3 years.

– DEMAND DRIVERS – International buyers continued to play a key role in demand. Record low mortgage rates as well.

– HIGH END MARKET RISING WITH ENTIRE MARKET – Luxury market price trends rising consistent with gains in overall market.

Here’s an excerpt from the report:

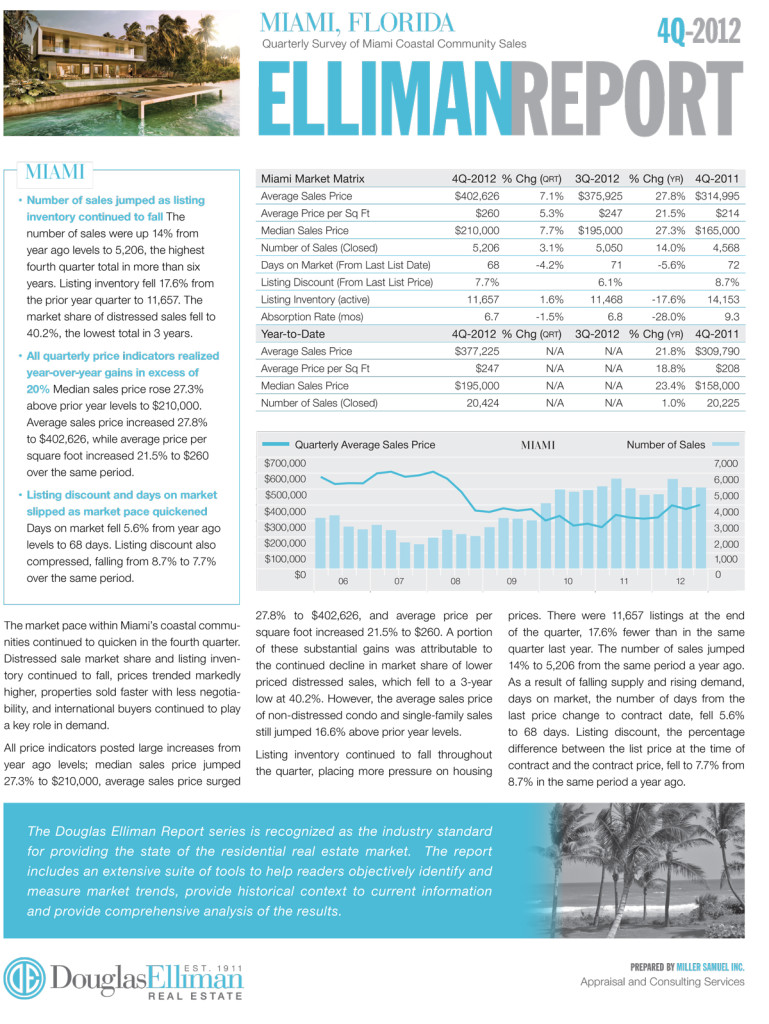

…The market pace within Miami’s coastal communities

continued to quicken in the fourth quarter.

Distressed sale market share and listing inventory

continued to fall, prices trended markedly

higher, properties sold faster with less negotiability,

and international buyers continued to play

a key role in demand.All price indicators posted large increases from

year ago levels; median sales price jumped

27.3% to $210,000, average sales price surged 27.8% to $402,626, and average price per

square foot increased 21.5% to $260. A portion

of these substantial gains was attributable to

the continued decline in market share of lower

priced distressed sales, which fell to a 3-year

low at 40.2%. However, the average sales price

of non-distressed condo and single-family sales

still jumped 16.6% above prior year levels…

You can build your own custom data tables on the Miami sales market – now updated with 4Q 12 data. I’ve also updated the charts on the Miami sales market.

_________________

The Elliman Report: 4Q 2012 Miami Sales [Miller Samuel]

The Elliman Report: 4Q 2012 Miami Sales [Douglas Elliman]