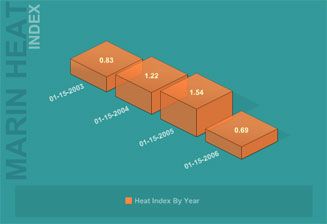

A real estate broker in California has come up with a clever way of tracking the direction of the real estate market using his [Marin Market Heat Indexâ„¢](http://www.marinheatindex.com/index.php)

“The Marin Market ‘HEAT’ Index (MMHI), is an indicator of the intensity of buyer competition for listed residential properties at the current time, a snapshot of conditions. Higher numbers indicate more buyer competition for each home on the market; lower numbers mean less intense, lower levels of buyer competition for each listed home. This measure includes single family homes and condominiums—other types of real estate are excluded…

The index is derived by:

* adding the number of closed residential sales in the prior 30 days to

* the number of current pending residential sales, then

* dividing this sum by the total number of active and available-for-sale homes & condos.”

I have seen variations of this index before but this index seems more thought out than most. The language and presentation is a bit too brokerish to be consider fully authoratative, plus you have no sense of the size of the data set that goes into its calculations. That would go a long way to establishing credibility. The use of the word “Heat” infers bias from the start as in “hot market”, “sizzling real estate”, etc.

I don’t like indexes applied to real estate market because the general distrust of information that is diseminated within the industry already. An index requires another leap of faith. In fact, I am not aware of a widely used real estate index, national in scale that is well-regarded. I think that says a lot since national figures include a large enough data set for the application of just such an index.

Just because Dow Jones can do it, doesn’t mean real estate can.